Shares of Advanced Micro Devices (AMD) jumped in after-hours trading after the chipmaker reported Q1 earnings results. Earnings per share came in at $0.96, which beat analysts’ consensus estimate of $0.94. In addition, sales increased by 36% year-over-year, with revenue hitting $7.44 billion. This beat analysts’ expectations of $7.12 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This increase in sales was primarily driven by its Data Center segment, which saw revenue jump by 57% year-over-year to $3.7 billion. The main cause of this jump was a steep increase in Instinct GPU shipments, along with strong growth in AMD EPYC CPU sales.

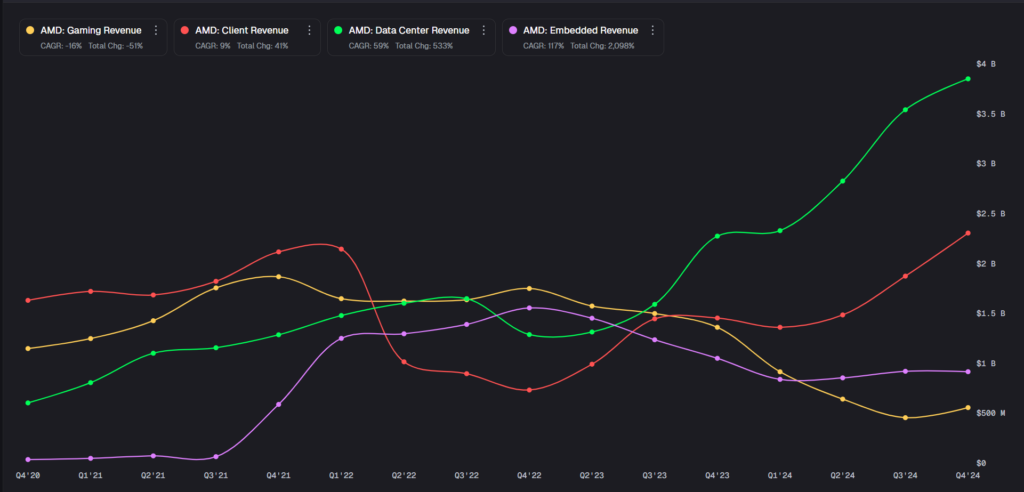

However, its Gaming segment saw a 30% year-over-year decrease to $647 million. This was due to a reduction in semi-custom revenue, which involves designing and manufacturing customized chips tailored to the specific needs of individual customers. Luckily for AMD, Data Center revenue makes up the bulk of the company’s revenue, while gaming is its smallest segment, as illustrated in the image below from Main Street Data.

Guidance for Q2 2025

Looking forward, management has provided the following guidance for Q2 2025:

- Revenue of between $7.1 billion and $7.7 billion versus analysts’ estimate of $7.24 billion

- Non-GAAP gross margin of approximately 43% when including $800 million in charges for inventory and related reserves due to the new export controls.

- Excluding the charge, non-GAAP gross margin would be approximately 54%

As we can see, the company’s revenue outlook at the midpoint of $7.4 billion was better than analysts’ expectations, which, when combined with this quarter’s solid results, led to a jump in the stock.

Is AMD a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMD stock based on 15 Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMD price target of $126.40 per share implies 28% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.