Shares of Advanced Micro Devices (AMD) are down in after-hours trading after the chipmaker reported Q3 earnings results. Earnings per share came in at $1.20, which beat analysts’ consensus estimate of $1.17. In addition, sales increased by 35.6% year-over-year, with revenue hitting $9.2 billion. This also beat analysts’ expectations of $8.76 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales were primarily driven by its Data Center segment, which saw revenue jump by 22% year-over-year to $4.3 billion. The main cause of this jump was strong demand for 5th Gen AMD EPYC processors and AMD Instinct MI350 Series GPUs. However, the Client and Gaming segment also showed excellent results after growing 73% to $4 billion.

Guidance for Q4 2025

Looking forward, management has provided the following guidance for Q4 2025:

- Revenue of between $9.3 billion and $9.9 billion versus analysts’ estimate of $9.2 billion

- Non-GAAP gross margin of approximately 54.5%

As we can see, the company’s revenue outlook at the midpoint of $9.6 billion is better than analysts’ expectations. However, AMD’s strong rally over the past month likely priced in today’s results, which is why its shares slipped in after-hours trading.

Is AMD a Buy, Sell, or Hold?

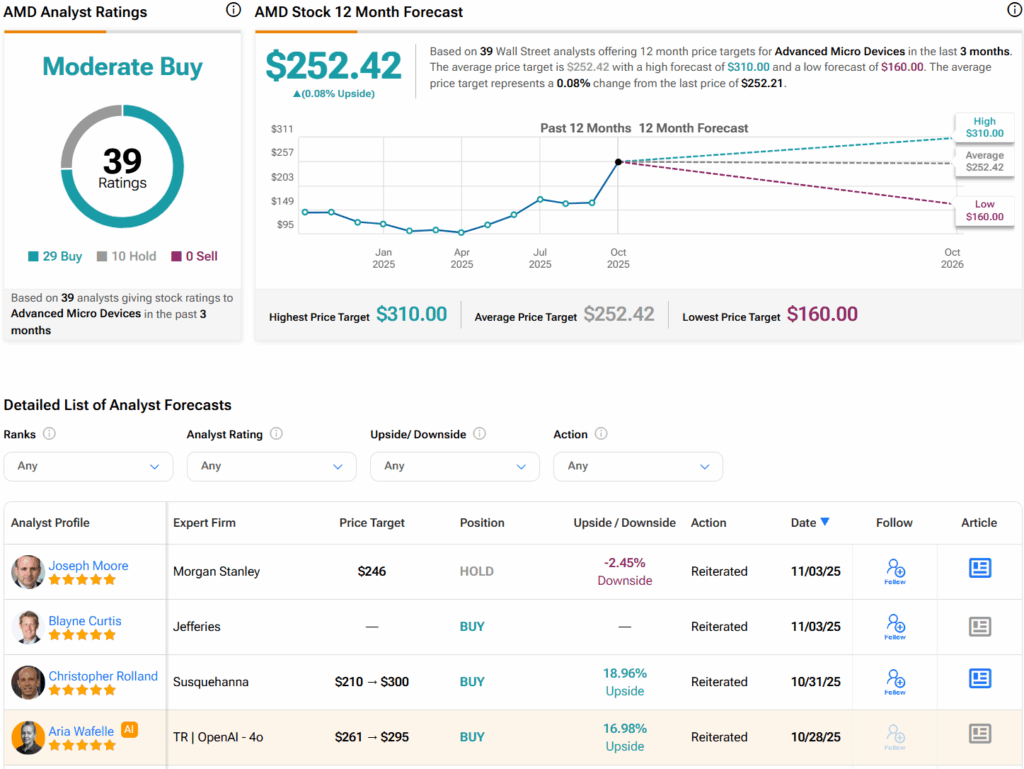

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMD stock based on 29 Buys, 10 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMD price target of $252.42 per share implies that shares are near fair value. However, it’s worth noting that estimates will likely change following today’s earnings report.