Advanced Micro Devices (AMD) CEO Lisa Su had good news for investors during the semiconductor company’s latest earnings call. She mentioned during it that, “We are planning for multiple customers at similar scales to OpenAI.” Su said that interest in its AI chips increased after the company announced its deal with OpenAI (OPAIQ).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the AMD CEO, the interest in its AI GPUs from other customers ensures “a broad customer base to mitigate concentration risk.” It could also be a massive boon to AMD stock, as the company’s shares underwent a huge rally after it announced the partnership to provide OpenAI with its AI GPUs.

News of growing interest in its AI chips is a big deal for AMD, as it has lagged behind rival GPU maker Nvidia (NVDA) in the sector. However, that could change with the launch of its next-generation chip, the Instinct MI450. This new AI GPU is set to be released sometime in 2026 and is expected to challenge Nvidia’s offerings.

AMD Stock Movement Today

AMD stock was down 2.64% on Friday but was still up 91.47% year-to-date. The shares have also increased 60.66% over the past 12 months. Investors will note that a significant portion of these gains is related to increased demand for AMD server components as a result of the AI boom.

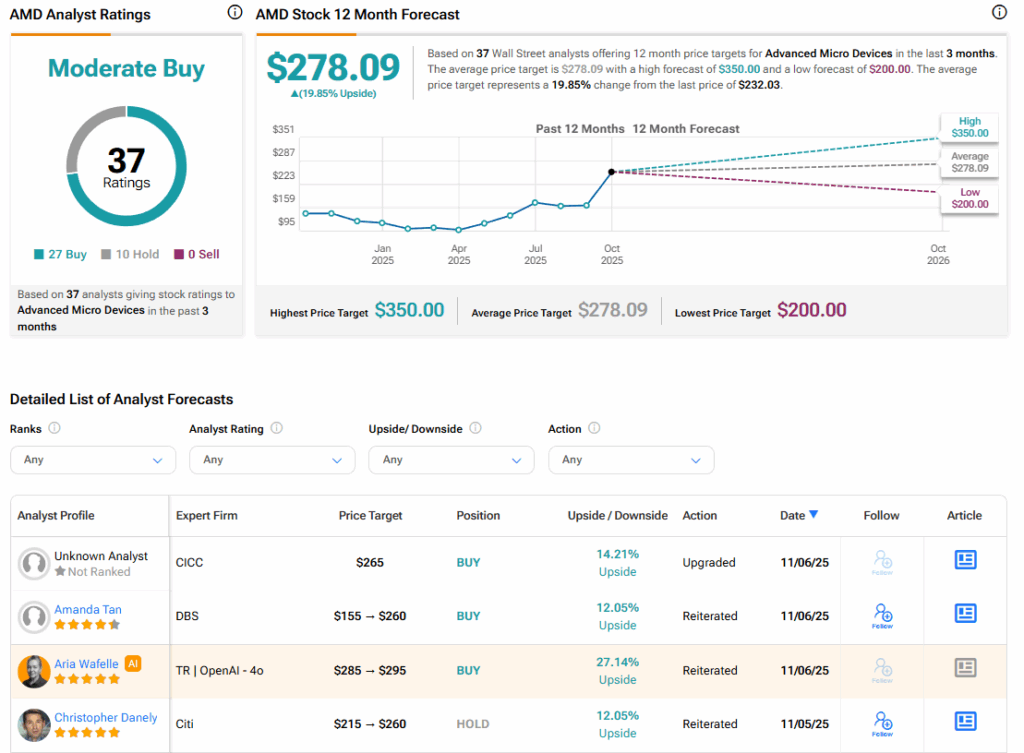

It also bears mentioning that AMD has received a large number of analyst updates this week. This follows its latest earnings report.

Is AMD Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 27 Buy and 10 Hold ratings over the past three months. With that comes an average AMD stock price target of $278.09, representing a potential 19.85% upside for the shares.