Amazon’s (AMZN) second Prime Day of the year became the company’s biggest October shopping event ever, breaking records for both sales and the number of items sold. This two-day event took place in 19 countries and offered Prime members significant discounts across various categories, from electronics and home goods to beauty and apparel.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The event saw increased participation among Prime members, making it Amazon’s largest shopping event in October.

Also, the event greatly benefited independent sellers, who make up more than 60% of Amazon’s sales. These sellers saw impressive results due to the increased traffic and engagement during Prime Day. It should be highlighted that shoppers saved over $1 billion on millions of deals.

Amazon Gears Up for the Holiday Season

The success of the October Prime Day event signals a positive outlook for Amazon’s performance in the upcoming holiday season. To prepare for the holiday rush, Amazon plans to hire 250,000 seasonal employees, anticipating a surge in demand and aiming to ensure a smooth shopping experience.

Looking ahead, Amazon aims to develop new technologies to improve shopping convenience for customers. Recently, the company introduced an AI tool called Vision Assisted Package Retrieval (VAPR) to speed up deliveries. The company also announced plans to open new pharmacies in 20 U.S. cities by 2025, offering customers easy access to same-day prescription delivery.

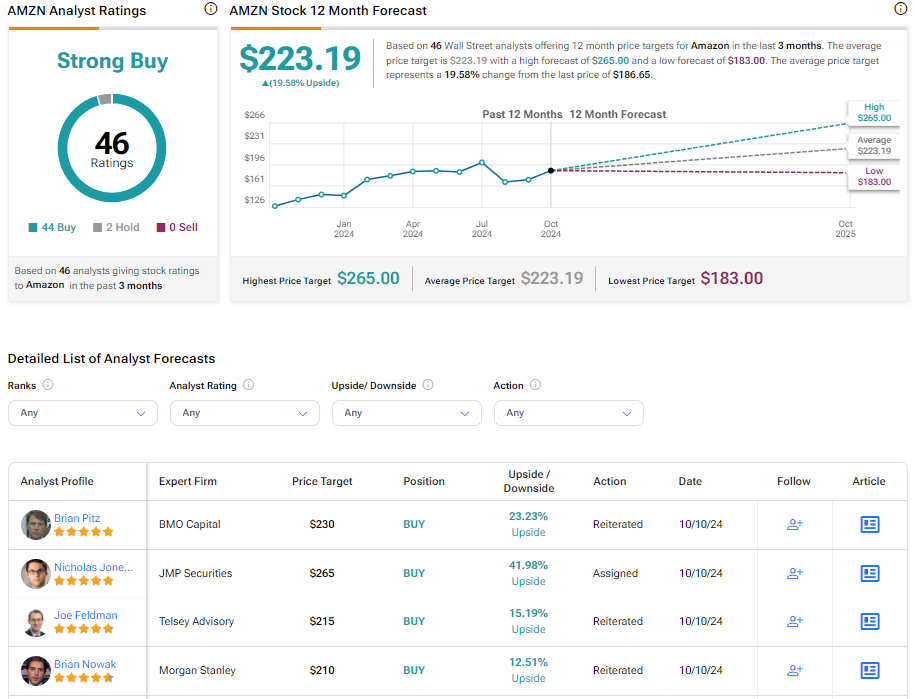

What Is the Price Target for AMZN?

Turning to Wall Street, AMZN has a Strong Buy consensus rating based on 44 Buys and two Holds assigned in the last three months. At $223.19, the average Amazon price target implies a 19.58% upside potential. Shares of the company have gained 22.84% year-to-date.