The National Football League (NFL) has settled on Amazon’s (AMZN) Amazon Web Services (AWS) as its cloud computing service. The league is to use AWS technology to create a thrilling schedule each season.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The NFL is constantly faced with an uphill task of creating an accommodative schedule for all 32 teams playing 272 games across 576 possible game windows, in addition to 17 regular-season games. Given that there are almost one billion schedule options for each team, and a quadrillion possible schedule combinations, AWS technology should make it easier for the league to develop the best possible schedule combination.

With the help of AWS, the NFL should be able to harness thousands of possible instances that work on different schedules. The technology should also make it easy to analyze rules and come up with an optimal program. (See Amazon stock analysis on TipRanks)

“It’s impossible to even think we could do this by hand, like we used to not that long ago,” says Mike North, VP of NFL Broadcast Planning. “So we’re fortunate to be able to use AWS technology and its massive computing power to help search through an infinite space and find the best possible schedule each year.”

Amid the NFL cloud computing deal, Amazon also continues to deepen its ties with Ford Motors (F). Bloomberg reported, as part of the latest deal, Amazon’s virtual assistant Alexa will be rolled out in approximately 700,000 Ford vehicles before year-end, marking the biggest single rollout of Alexa to date.

Monness Crespi Hardt analyst Brian J. White expects the COVID-19 to act as a catalyst in steering AWS to new heights. The analyst expects the company to exit the current crisis as one of the biggest beneficiaries given the ongoing digital transformation.

In a note to investors, White stated, “We expect the COVID-19 to drive accelerated digital transformation, benefiting the company’s business model. Moreover, the company has started to deliver more attractive profit trends over the past couple of years. However, as Amazon continues to aggressively invest back into the business to grow at a rapid rate, the company’s profitability is well below its long-term potential.”

The analyst has reiterated a Buy rating with a $4,500 price target on the stock implying 42.34% upside potential to current levels.

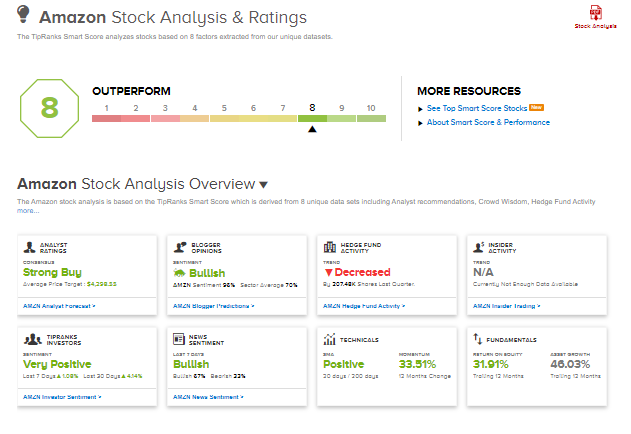

Consensus among analysts on Wall Street is a Strong Buy based on 31 Buy ratings. The average analyst price target of $4,298.55 implies 35.97% upside potential to current levels.

AMZN scores an 8 out of 10 on TipRanks’ Smart Score rating system, implying it is likely to outperform the overall market.

Related News:

Alphabet’s Google Inks Cloud Deals with SpaceX and PayPal

Alaska Air Expanding Fleet With 30 Mainline And Regional Aircraft

Google Fined €102M in Italy for Anti-Competitive Behavior