Amazon (NASDAQ:AMZN) delivered blockbuster Q3 results that gave the bulls plenty to savor. And the tech giant wasted no time keeping the momentum going, following up with yet another investor-pleasing move.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company became the latest to nab a deal with OpenAI. Amazon announced a multi-year strategic partnership with the ChatGPT maker valued at $38 billion. Under the deal, AWS will supply OpenAI with Amazon EC2 UltraServers to power and expand its core AI workloads, effective immediately. The full planned capacity is expected to be operational by the end of 2026, followed by continued expansion over the next seven years. OpenAI will begin using AWS’s existing data centers, with Amazon later constructing additional dedicated infrastructure for the company.

“Importantly,” said Wedbush analyst Scott Devitt, “we believe this deal builds on Amazon’s current partnership with Anthropic, serving as the company’s primary cloud provider.”

AWS has already exceeded a $130 billion run rate and continues to drive growth across the AI stack. In its latest quarterly report, Amazon posted its strongest year-over-year growth in AWS since 4Q22, up 20.2% and roughly 220 basis points above expectations. The gain reflects both increased capacity and solid demand across AI and core services. Over the past year, AWS has added more than 3.8 gigawatts of power, doubling its capacity since 2022 and remaining on track to double it again by 2027.

Supported by the rapid pace of backlog growth and an increased capex forecast for 2025, Devitt is optimistic about the demand outlook for the coming quarters.

“We think momentum will continue for the segment, and we highlight that AWS growth on a 2-year stacked basis has accelerated sequentially over the last five quarters, implying strong underlying performance when accounting for comp dynamics,” the analyst went on to confidently say. Additionally, management also noted that AWS growth would have been even higher this year if not for short-term capacity limitations, echoing similar remarks made by Alphabet during the same period.

With shares currently trading at “attractive” levels, the analyst sees potential for further multiple expansion, particularly as the recent “inflection in AWS growth” eases the main overhang on the stock. In Devitt’s sum-of-the-parts analysis, AWS represents about 44% of the company’s implied value, and the analyst believes that “considerable value” remains in the other core segments, something that has been underappreciated in recent times.

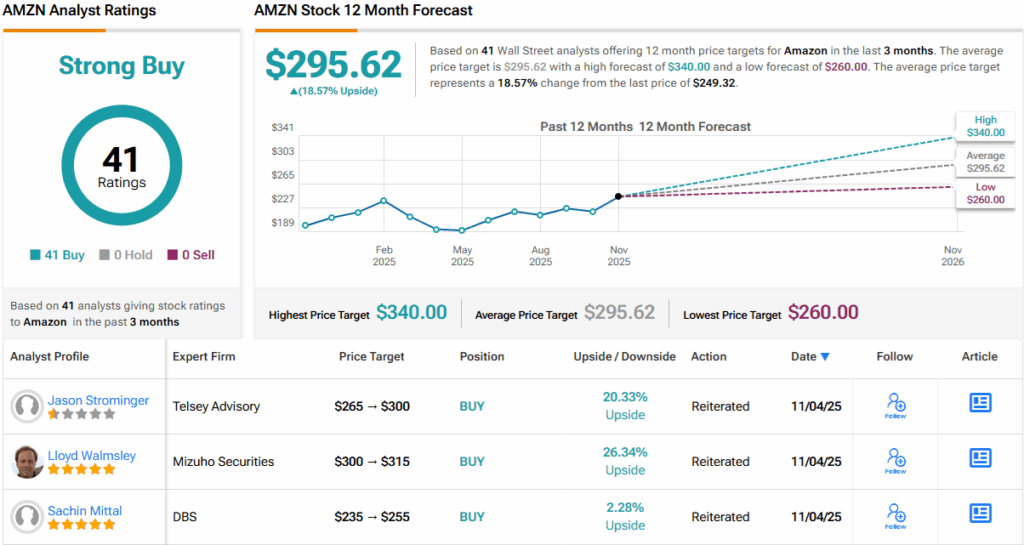

Bottom line, Devitt assigns AMZN shares an Outperform (i.e., Buy) rating, while raising his price target from $330 to a new Street-high of $340. The implication for investors? Upside of 36% from current levels. (To watch Devitt’s track record, click here)

None of Devitt’s colleagues has an issue with that take. Based on a unanimous 41 Buys, AMZN stock claims a Strong Buy consensus rating. At $295.62, the average price target points toward one-year gains of ~19%. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.