Shares of tech giant Amazon (NASDAQ: AMZN) dipped at the time of writing after the Wall Street Journal reported that the Federal Trade Commission is suing Amazon and has alleged that the company enrolled consumers without consent into Amazon Prime. As a result, this made it difficult for them to cancel their subscriptions. Amazon Prime costs $139 on an annual basis. FTC Chair Lina Khan stated, “Amazon tricked and trapped people into recurring subscriptions without their consent, not only frustrating users but also costing them significant money.” FTC has filed a complaint in federal court in Seattle seeking monetary civil penalties without specifying the exact amount.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The complaint alleges that Amazon used “manipulative, coercive, or deceptive user interface designs known as dark patterns” to lure users into automatically renewing their Prime subscriptions and made it difficult “for users to cancel Prime because those changes adversely affected Amazon’s bottom line.”

This complaint comes just as AMZN announced today that its Prime Day event will be held between July 11 and July 12 this year, with new deals likely to drop every 30 minutes during select periods throughout the Prime Day event. Amazon did not give any indication whether it will hold a second Prime Day event later this year, similar to last year.

Meanwhile, while Amazon’s crown jewel, Amazon Web Services (AWS), is experiencing slowing growth, with its revenues growing year-over-year by just 16% in Q1, Jeffries analyst Brent Thill remains bullish on AWS’ prospects. The analyst reiterated a Buy on the stock and believes that AMZN’s cloud computing business, AWS, could be a “core beneficiary” of the rise of AI.

Thill commented, “While AMZN lags its mega-cap peers in generative AI capabilities today, the AI opportunity remains early, and we expect AMZN’s rich history of innovation will help them close the AI gap over time.”

The analyst has projected that operating margins are likely to be 3.9% in FY23, up from 2.4% as the company’s profitability continues to improve, with growth for AWS likely to re-accelerate as customers could expand their budgets and cloud optimization headwinds reduce.

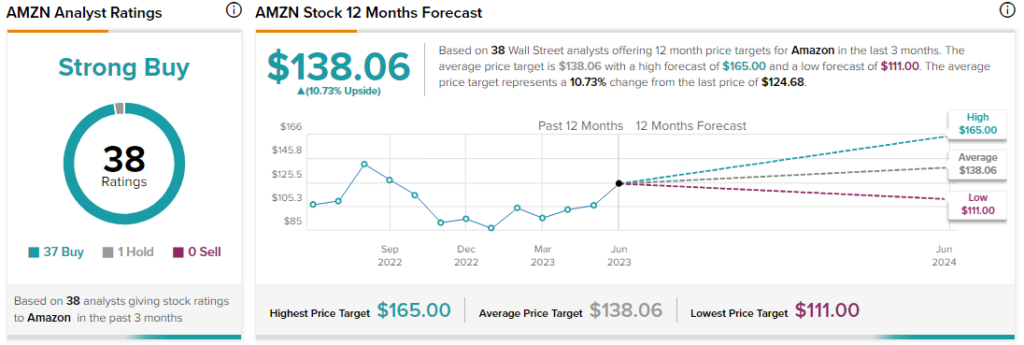

As a result, the analyst is of the opinion that even with the stock soaring by more than 40% year-to-date, AMZN retains more upside. Thill raised the price target on AMZN to $150 from $135, implying an upside potential of 19.1% at current levels.

Overall, analysts are bullish about AMZN stock with a Strong Buy consensus rating based on 37 Buys and one Hold.