Amazon (NASDAQ:AMZN) stock has rallied more than 85% over the past year and is up nearly 19% year-to-date. Analysts see more upside in the stock, backed by multiple tailwinds, including solid financials, streamlining efforts to improve profitability, a dominant position in e-commerce and cloud computing, a rapidly growing advertising business, and prospects in artificial intelligence (AI).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amazon’s Robust Growth Potential

Amazon struggled due to excessive investments in its fulfillment centers and other areas and a slowdown in e-commerce sales following the spike in business during the pandemic. However, the company has shown significant improvement in its performance over the recent quarters, thanks to recovery in the e-commerce space and aggressive cost reduction and streamlining efforts.

The company impressed investors with its upbeat fourth-quarter performance. Sales grew 14% to $170 billion, driven by strong top-line growth in the retail and Amazon Web Services (AWS) cloud computing businesses. Higher sales and the company’s cost reduction measures helped boost the earnings per share (EPS) to $1.00 in Q423 from $0.03 in the prior-year quarter.

Amazon’s e-commerce business is gaining from its initiatives to improve customer experience and the regionalization of the U.S. fulfillment network to enhance delivery speed. Also, the AWS unit is set to see better times ahead, as the company is seeing clients’ spending optimizations diminish. Further, CFO Brian Olsavsky said that AWS clients are showing a lot of interest in generative AI products like “Q,” which is an AI chatbot for businesses.

Another key aspect is the impressive growth in the company’s advertising business, which delivered a 27% rise in its revenue to $14.7 billion. The company’s investments in AI are also expected to boost its prospects. Earlier this week, Amazon announced an additional $2.75 billion investment in Anthropic, builder of the GenAI chatbot Claude, after investing $1.25 billion initially in the startup.

Is Amazon a Buy, Sell, or Hold?

Reacting to the recent investment in Anthropic, Bank of America analyst Justin Post said that AMZN’s support indicates confidence in Claude’s potential. While investors may think that Amazon is trailing Microsoft’s (NASDAQ:MSFT) Azure in generative AI capabilities in the cloud, the analyst thinks that this opinion might change as Anthropic’s abilities converge with OpenAi’s ChatGPT and AWS starts gaining from AI-induced growth.

Post reiterated a Buy rating on AMZN stock with a price target of $204.

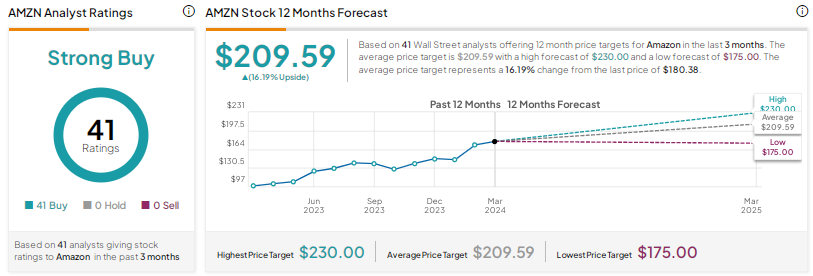

Overall, Wall Street is highly bullish on Amazon stock, with a Strong Buy consensus rating based on 41 unanimous Buys. The average AMZN stock price target of $209.59 implies 16.2% upside potential.

Conclusion

Even after a strong run over the past year, analysts see further upside potential in AMZN stock. Wall Street is highly bullish on the company’s long-term growth prospects, given its leadership in e-commerce and cloud computing and catalysts like AI-induced demand and the growing advertising revenue.