As befitting a company of Amazon’s (NASDAQ:AMZN) size, it is a big player in the digital advertising industry. The company appears to be on track to generate an estimated advertising revenue of $46.5 billion in 2023. While this is a substantial amount of money, one top Wall Street analyst believes there is plenty more to come.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wedbush’s Scott Devitt, a 5-star-rated analyst ranking in the top 4% of Wall Street’s stock experts, thinks Amazon’s ad opportunity has yet to properly play out. “After taking a closer look at the scope of Amazon’s advertising platform and evaluating the direction of recent product announcements, we believe Amazon’s advertising opportunity remains early in its development,” Devitt opined.

As the company goes after a bigger share of digital advertising revenue beyond “endemic categories” and its own properties, initiatives such as the August announcement of the extension of Sponsored Product ads offsite, Prime Video ads monetization in 2024 (which Devitt reckons represents a ~$6.5 billion incremental revenue opportunity), and continuous efforts to bring in non-endemic advertisers amount to “relatively untapped opportunities.”

“These initiatives build on top of Amazon’s organic GMV (gross merchandise volume) growth (which drives advertising growth) and ongoing increases in penetration of on-platform advertising by Amazon’s vendors and merchants,” Devitt explained. “Combined, we see a sustainable runway of advertising revenue growth well above the GMV growth rate of the core retail business.”

In addition to expecting Amazon’s advertising revenue growth to keep on significantly outperforming the wider digital advertising industry, with retail margins on the rise and expecting an acceleration of AWS against a backdrop of “easing comps,” Devitt thinks Amazon is especially “well positioned” for 2024.

In lieu of higher expectations, Devitt has raised some of his estimates. The analyst now sees 2024 advertising revenue reaching $57.4 billion (~3% higher than consensus) and consolidated operating income of $47.8 billion (~2% above Street levels). “Looking ahead,” Devitt summed up, “we see a path to $100B+ of AWS revenue in 2024, $100B+ of FCF in 2026, and $100B of advertising revenue in 2028.”

Not stopping there, Devitt calls Amazon his ‘top pick’ across internet coverage, as he maintains an Outperform (i.e., Buy) rating and thinks it is time for a price target hike. His objective moves from $180 to $210, suggesting shares have room for additional gains of 37% over the next year. (To watch Devitt’s track record, click here)

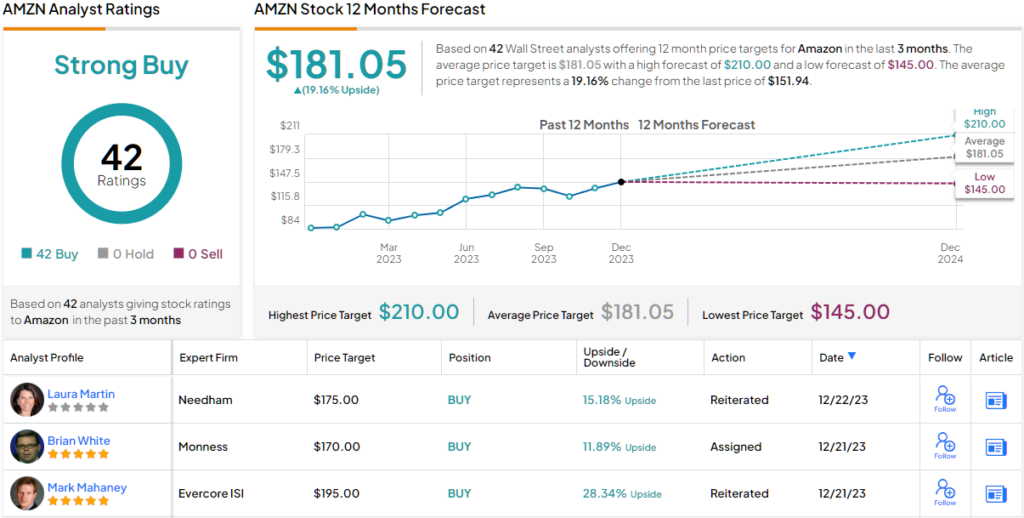

There have been plenty of Amazon reviews submitted in recent months and they all share the same trait; all 42 of them are positive, naturally culminating in a Strong Buy consensus rating. The average target stands at $181.05, implying share appreciation of 19% over the one-year timeframe. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.