On Monday, a significant outage at Amazon’s (NASDAQ:AMZN) AWS brought down apps and websites across the globe. According to Downdetector, over 2,000 companies were impacted, with 8.1 million user reports of issues, including 1.9 million in the U.S. and 1 million in the U.K. Users reported problems with services such as Disney+, the McDonald’s app, Snapchat, The New York Times, Reddit, Robinhood and United Airlines. By Monday evening, however, Amazon confirmed that all AWS services had returned to normal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, on the same day, Bernstein analyst Mark Shmulik, an analyst who ranks among the top 5% Wall Street stock pros, wondered in a research note whether AWS holds the “last place in AI.”

“It’s hard to argue otherwise,” the 5-star analyst explained. “One just needs to look at the slower cloud revenue ‘growth rate,’ GPU allocation tables, where tech startups are building, Andy Jassy’s commentary, and stock performance vs. peers to get your answer.”

However, Shmulik also raises doubts about whether this actually matters in the grand scheme of things. The analyst admits that he often focuses on minor basis-point movements in cloud growth, yet 2Q25 marked AWS’ second-highest quarter for net new dollar growth. And while AWS is currently facing capacity constraints, these are beginning to ease. The partnership with Anthropic seems stronger than comparable collaborations, and its revenue impact is expected to materialize soon.

“Sector investment levels point to a bigger cloud TAM, and AWS remains the benchmark for enterprise cloud,” Shmulik added.

So, how can AWS shed the “’AI laggard’ label?”

Shmulik sees potential for acceleration. SSO (single sign-on) data suggests record Q4 acceleration in core non-AI compute, the Anthropic training program is poised to ramp up, and Shmulik expects enterprise AI adoption to gain momentum, going on the assumption that many companies would prefer to purchase AI products from their primary cloud provider.

“A good story starts with good numbers,” Shmulik summed up. “We see upside to AWS numbers and narrative around Re:Invent (December 1-5). Like Google search, that’s good enough for now.”

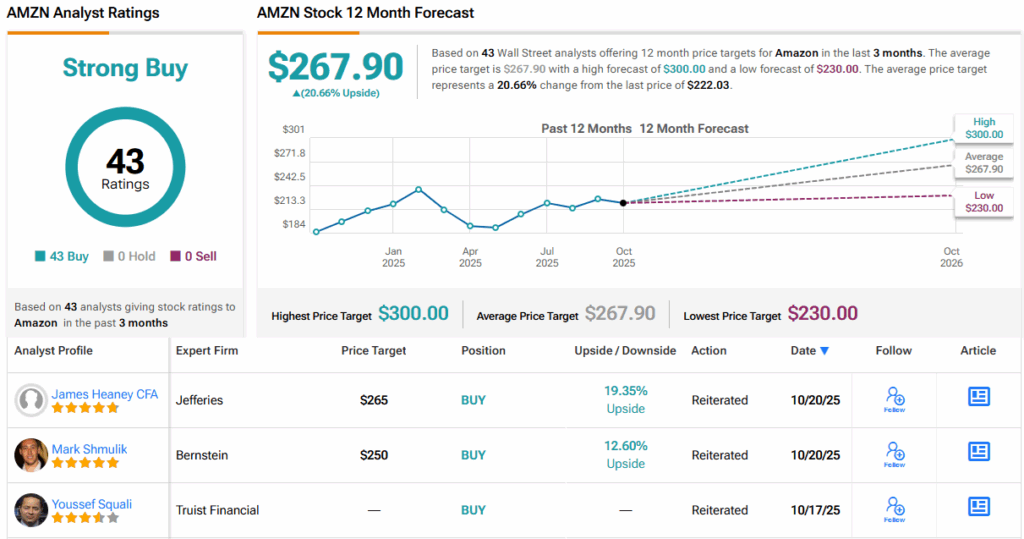

Bottom line, Shmulik maintained an Outperform (i.e., Buy) rating on AMZN shares, backed by a $250 price target. This implies a potential upside of ~13% from current levels. (To watch Shmulik’s track record, click here)

AMZN stock gets plenty of positive coverage on Wall Street; the stock claims a Strong Buy consensus rating, based on a unanimous 43 Buys. Going by the $267.90 average price target, shares could be changing hands a year from now for a ~21% premium. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.