The cloud computing platform of Amazon (NASDAQ:AMZN), known as Amazon Web Services (AWS), has declared its intention to invest €7.8 billion ($8.44 billion) in Germany by 2040. This investment aims to build cloud computing infrastructure tailored specifically for Europe.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In line with this initiative, AWS announced last year its intention to store data on servers located within the EU, aiming to enhance data privacy measures. Additionally, AWS plans to inaugurate data centers in Brandenburg by 2025. This investment is anticipated to create job opportunities, supporting approximately 2,800 local German jobs annually.

AWS’s CEO Steps Down

Meanwhile, the tech giant announced on Tuesday that AWS’s CEO, Adam Selipsky, will step down from his position next month. Matt Garman, SVP of sales and marketing at Amazon Web Services, will transition to the position of AWS’s CEO after Selipsky’s exit.

According to a CNBC report, Selipsky was leaving AWS after 14 years to prioritize family time. He expressed optimism for the cloud business in a memo to employees.

Analysts Bullish about AWS

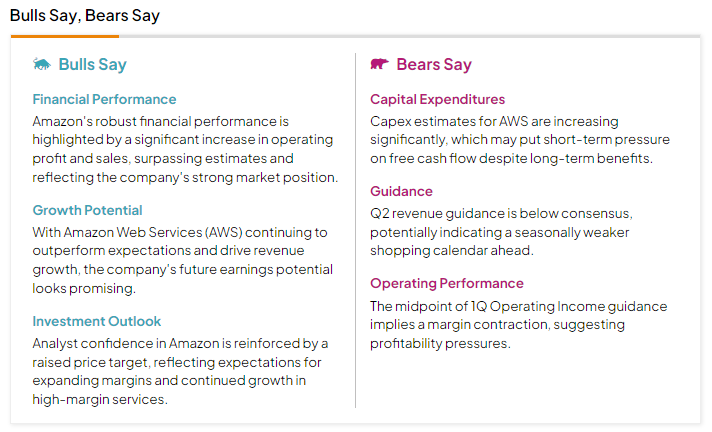

AWS is increasingly a key component of Amazon’s business and generated revenues of $25 billion in Q1, an increase of 17% year-over-year. Indeed, Wall Street analysts are also bullish on this business and according to the TipRanks Stocks Analysis tool, “Bulls Say, Bears Say,” the growing success of the AWS business points towards a promising “future earnings potential” of the company.

Is Amazon a Buy, Hold, or Sell?

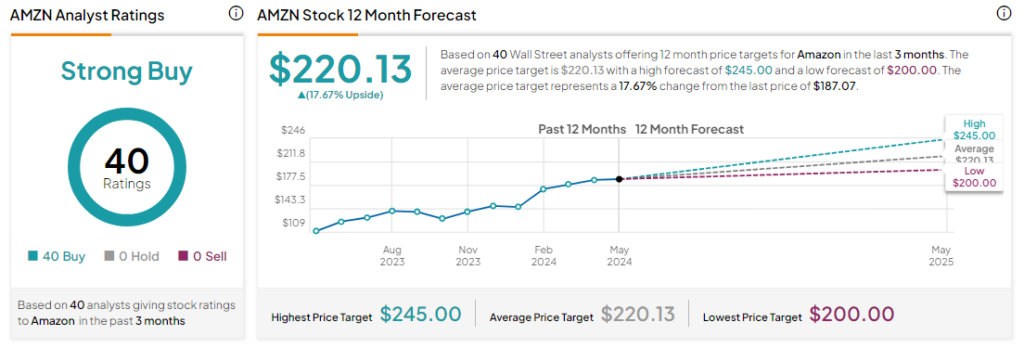

Analysts remain bullish about AMZN stock, with a Strong Buy consensus rating based on unanimous 40 Buys. Over the past year, AMZN has surged by more than 65%, and the average AMZN price target of $220.13 implies an upside potential of 17.7% from current levels.