Getting internet access everywhere people are isn’t exactly an easy job. But there are signs that the digital divide between the city and country is fading, and the latest word out of Amazon (NASDAQ:AMZN) makes that much clearer. The Project Kuiper plan worked out well, it noted, but that wasn’t enough to keep investors in the fold, and Amazon is down fractionally in Thursday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Both of Amazon’s prototype satellites, Amazon noted, were a complete success in both testing and overall operations. They’ve been aloft for the last 30 days, and not only is it offering sufficient power to stream in 4K, but they also make and receive video calls and, yes, shop on Amazon.com. The concept has officially been proven, and now, Amazon is looking to expand outward and start getting the Kuiper satellites into orbit and offering internet access to the places whose choices may not be so great. Amazon looks to drop as much as $10 billion into the project, with a $120 million pre-launch facility now operational in Florida.

Bridging the Digital Divide

This is almost certainly going to make Starlink nervous. Starlink is offering impressive internet access at high speeds throughout large parts of the world, even for those who don’t have regular internet access. It’s a go-almost-anywhere, do-almost-anything proposition, but it costs an arm and a leg. Service costs $599 just for the hardware itself, and on top of that, customers will pay $120 per month for the service, and that’s just for “standard residential” service. Users are getting access to speeds between 25 Mbps and 220 Mbps, reports note, depending on location. That’s on par with or well ahead of several alternatives. Amazon will have its work cut out for it, but if it can offer service anywhere near that level at better prices, it may have a Starlink-killer on its hands.

Is Amazon a Buy, Sell, or Hold?

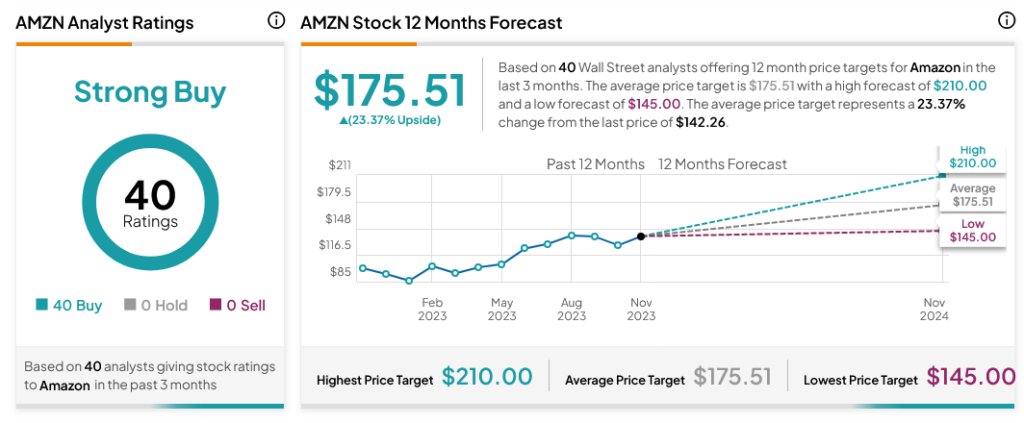

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 40 Buys assigned in the past three months, as indicated by the graphic below. After a 49.93% rally in its share price over the past year, the average AMZN price target of $175.51 per share implies 23.37% upside potential.