Amazon stock (NASDAQ:AMZN) has registered exceptional gains in recent months, earning praise from Wall Street for its promising free cash flow prospects. In FY2023, Amazon’s free cash flow surpassed $32 billion, with consensus estimates suggesting it could reach $100 billion within three years. This trend is being driven by growing sales and margins in its retail division and enduring strength in Amazon’s cash cow division, AWS. However, the stock’s valuation appears rather rich. Thus, I’m neutral on AMZN stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Improving Delivery Times, Advertising, Propell the Retail Business

Starting with Amazon’s retail business, the division posted growing sales and profits in Q4, led by delivery efficiencies and significant momentum in Advertising. Notably, Amazon made progress in delivery speeds, which helped drive robust sales throughout the quarter. This included notable strength in last-minute gifting, where Amazon’s ability to provide fast shipping helped its Prime members ensure that they got their gifts before the holidays.

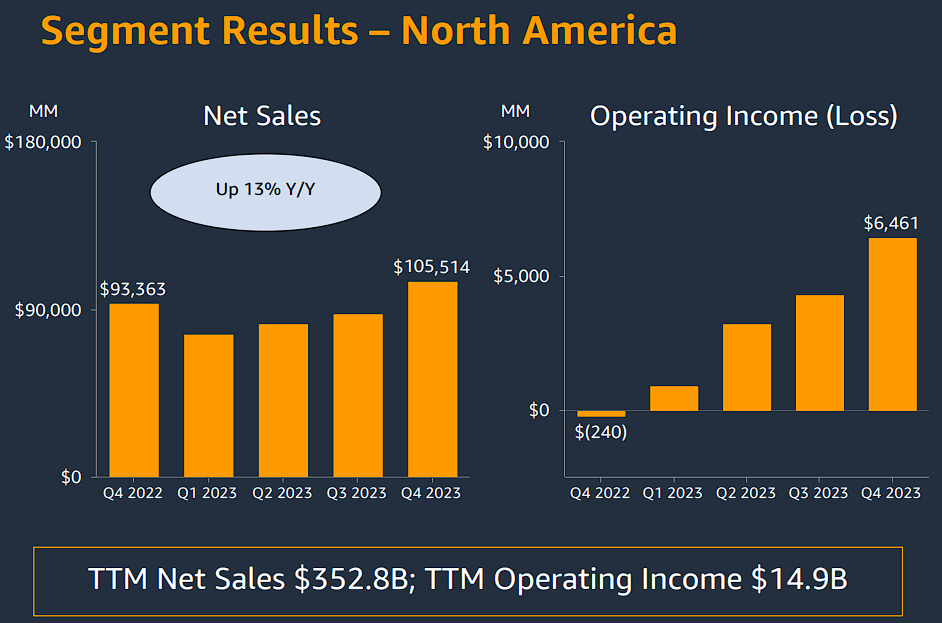

Thus, for the quarter, North America retail sales grew by 13% to $105.5 billion, while International retail sales grew by nearly 17% to $40.2 billion. These increases allowed Amazon to benefit from economies of scale and improve its margins. Thus, the North America segment posted an operating profit of $6.5 billion, surfacing from last year’s operating loss of $240 million.

Additionally, while the International segment did record an operating loss of $419 million, this was still a significant improvement from last year’s loss of $2.2 billion.

Let’s take a deeper look at the factors that led to these improvements in Amazon’s retail business.

Third-Party Sellers Capitalize on Amazon’s Faster Fulfillment Times…

Third-party sellers capitalized on Amazon’s faster fulfillment times, a significant contributor to higher Q4 sales. Evidently, worldwide third-party seller services sales grew by 19% year-over-year in constant currency. Moreover, Amazon achieved its highest-ever global third-party seller unit mix, which came in at 61%, underscoring the boosted motivation for sellers to list their products on Amazon’s marketplace. This is a great indicator of the resilience and attraction of Amazon’s ecosystem as a whole.

…Spurring Increased Competition and Amplifying Advertising Growth

Another pivotal catalyst propelling Amazon’s retail success is its rapidly growing Advertising business, which posted year-over-year revenue growth of 26% in Q4. Interestingly, the growth in Advertising is directly linked to the growing competition among third-party sellers, as I just mentioned earlier.

With a growing number of sellers vying for sales on Amazon’s platform, it’s no surprise that many are willing to invest in advertising to increase the visibility of their products and overcome the intensified competition.

Amazon gains from both ends of the spectrum. It records higher sales fees from increased sales volumes due to a higher number of sellers while earning advertising fees as these sellers compete with one another for visibility and consumer attention.

Generative AI Has Started to Have an Actual Effect on Sales

Generative AI also played a pivotal role in boosting retail sales during Q4, contributing to improving the customer experience while helping Amazon respond further to the underlying increase in demand.

Customers benefited from streamlined purchasing processes, as they could now access brief summaries of product reviews instead of sifting through numerous ones. Further, generative AI has started to offer intuitive recommendations tailored to individual preferences, also powering sales growth.

For Amazon, by deploying generative AI in its fulfillment centers, the company can now forecast how much inventory is going to be needed in each particular fulfillment center. This helps manage inventory way more efficiently and, as already mentioned in the successes of Q4, improves the fulfillment and delivery times. In turn, this further drives increased sales.

AWS Remains a Cash Cow Despite Decelerated Growth

Moving to AWS, I have to say that I have been disappointed by its decelerating growth to some extent. With Microsoft’s (NASDAQ:MSFT) Azure and Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) Google Cloud fighting for market share, AWS’s growth rates are nowhere near the levels of some years ago. In fact, AWS posted revenue growth of 13% in Q4, notably lower than Azure’s growth of 30% and Google Cloud’s growth of 26%.

Regardless, having capitalized on its first-mover advantage, AWS already has captured significant market share and is, at this point, a great cash cow for the business. AWS posted an operating profit margin of nearly 30%, resulting in its operating income surging to $7.2 billion, up 38% compared to last year

Free Cash Flow Skyrockets, Could Reach $100 Billion by 2026

With both the retail division and AWS contributing to profitability in Q4 and FY2023, along with Amazon reducing its capital expenditures (CapEx), free cash flow for the year (excluding principal repayments of finance leases) surged to $32.2 billion – a massive jump from an outflow of $11.6 billion in the previous year.

With a renewed focus on profitability and fewer CapEx requirements in the coming years, Wall Street sees free cash flow snowballing from here. Particularly, consensus estimates see free cash flow touching $61.9 billion, $77.8 billion, and $96.6 billion in Fiscal 2024, Fiscal 2025, and Fiscal 2026, respectively. Similarly, an article from Barron’s talks about free cash flow potentially reaching $100 billion in three years.

Be Mindful of the Valuation

Amazon’s free cash flow prospects appear absolutely thrilling. That said, I would suggest that investors be mindful of the valuation. The stock’s extended rally over the past year has pushed its multiples higher.

Even with free cash flow expected to surge to $61.9 billion next year, this implies a rich forward price-to-free-cash-flow multiple of 30x. From an earnings perspective, Amazon’s forward P/E also stands at a hefty 42.5. With interest rates remaining at elevated levels and Amazon already having captured a notable chunk of the underlying markets it serves, investors might want to be cautious at the stock’s current price levels.

The Takeaway

Amazon has shown remarkable recent performance, with strong showings in both its retail and AWS divisions. Retail operations are becoming more efficient, attracting increasing third-party sellers and driving innovation through generative AI implementation.

At the same time, AWS has grown into a true cash cow for the company. Amazon’s ongoing momentum in both divisions is driving tremendous free cash flow growth.

However, despite the promising trajectory, investors should exercise caution due to the stock’s rich valuation, which could prove to be a headwind to the stock’s future returns.