In a major win for tech giant Amazon (NASDAQ:AMZN), Europe’s Court of Justice overturned an EU order that required the company to pay €250 million ($273 million) in back taxes to Luxembourg. The tax order was a part of the EU antitrust head Margrethe Vestager’s crackdown on advance pricing agreements (APAs) or “sweetheart deals” between multinationals and EU countries.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These advance pricing agreements try to lure multinational companies to EU countries by offering lucrative tax arrangements. In its ruling, the Court of Justice stated that the European Commission failed to prove Amazon had received incompatible state aid from Luxembourg.

Amazon welcomed the ruling and commented, “We welcome the Court’s ruling, which confirms that Amazon followed all applicable laws and received no special treatment. We look forward to continuing to focus on delivering for our customers across Europe.”

Is AMZN a Buy Right Now?

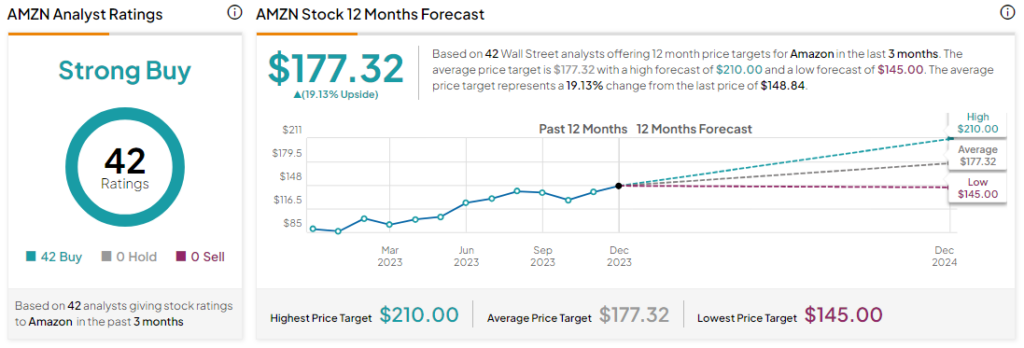

Analysts remain bullish about AMZN stock with a Strong Buy consensus rating based on 42 unanimous Buys. In the past year, AMZN has gained by more than 60% and the average AMZN price target of $177.32 implies an upside potential of more than 19.1% at current levels.