Internet commerce giant Amazon (NASDAQ:AMZN) has added a new robotic system called Sequoia to bolster its delivery speed. The move aligns with the company’s strategy to boost its e-commerce sales, as fast delivery plays a pivotal role in driving the order frequency and the average order value on its platform. In addition to Sequoia, AMZN introduced Digit, a robot to elevate workplace safety. Let’s delve deeper.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amazon to Make Delivery Faster

The new robotic system will enable the company to list items for sale on Amazon.com more quickly, as Sequoia can identify and store inventory up to 75% faster. Moreover, it will reduce the order processing time by up to 25%. This will enhance its shipping predictability and expand the range of products Amazon can offer for Same-Day or Next-Day shipping. Currently, Amazon is using Sequoia at one of its fulfillment centers in Houston, Texas.

Amazon CEO Andrew Jassy said during the Q2 conference call that “customers care a lot about faster delivery.” Jassy highlighted that the reduction in delivery time increases the order frequency on Amazon’s platform. Moreover, it boosts the order value and increases the chances of repeat purchases.

Earlier, the company announced the expansion of its ultra-fast drone deliveries outside the U.S. Furthermore, Amazon is reshaping its fulfillment and transportation infrastructure and is moving towards the establishment of eight regional hubs, each catering to smaller geographic areas, as opposed to maintaining a single national network within the United States. This will make delivery faster and less expensive.

As Amazon is taking steps to enhance the efficiency and cost-effectiveness of its delivery process, let’s look at what the Street recommends for its stock.

What is the Future Outlook for Amazon Stock?

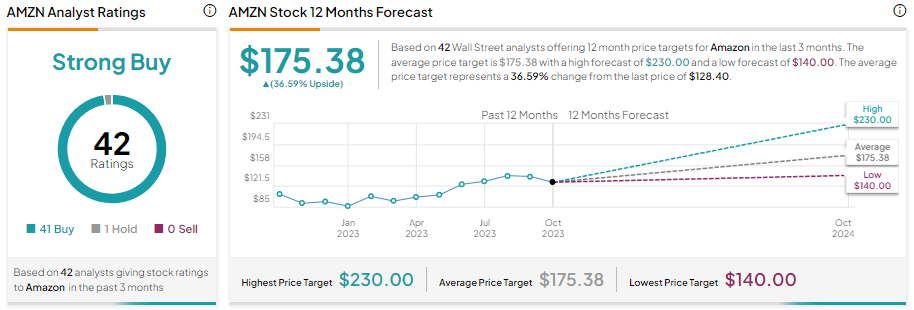

Wall Street analysts are bullish about Amazon stock. The company’s initiatives to improve its delivery speed are expected to drive its e-commerce sales. In addition, its efforts to boost profitability, integration of AI (artificial intelligence) into its AWS’ (Amazon Web Services) suite of services, and strong advertising revenue provide a solid foundation for long-term growth.

Given these positives, Amazon stock has received 41 Buys and one Hold recommendation for a Strong Buy consensus rating. Further, the average AMZN stock price target of $175.38 implies 36.59% upside potential from current levels.