Online retailer Amazon (NASDAQ:AMZN), part of the FAANG stock coalition, recently engaged in a couple of moves that, on the surface, seem downright contradictory. Despite this strange new path, Amazon stock is doing well with investors. It’s up significantly going into Tuesday afternoon trading, even if it’s getting a little confusing.

The first move—commonly believed to be behind the share price expansion—was Amazon expanding its “Buy With Prime” program. Retailers that put Buy With Prime to work will have access to a range of extra features, starting with free delivery and a smoother user experience. In addition, they can see average increases of about 25%, reports note.

Despite this move to expand Prime, Amazon also did something that seems in direct opposition to such a move. It announced it would close down three warehouses in the UK. The warehouses in question are located at Doncaster, Gourock, and Hemel Hempstead. The move won’t impact jobs; every employee will be offered a new position elsewhere.

Nevertheless, cutting down Amazon’s warehouse presence doesn’t seem like a good way to keep up with the potential of expanding orders. Though with employees running insider activism on climate change, it may be that Amazon’s looking to consolidate its employees in fewer branches for easier monitoring.

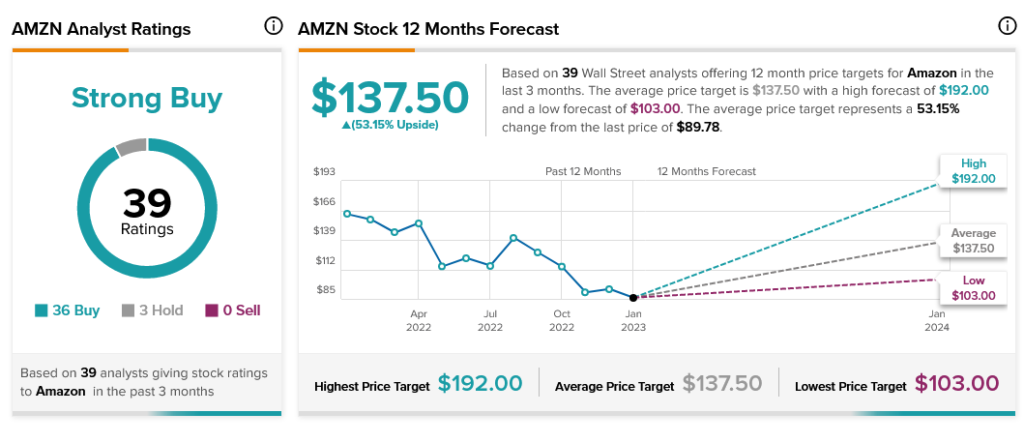

Some might call these moves unexpected and a bit contradictory. However, there’s nothing contradictory about Wall Street’s position on Amazon. Analyst consensus considers AMZN stock a Strong Buy, with an upside potential of 53.15% thanks to their average price target of $137.50.