Amazon.com Inc. (AMZN) has been accused of investing in startups to steal their ideas to create competing products, according to July 23 report from the Wall Street Journal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Numerous startups outline a process that usually started with Amazon expressing interest in their company. In some cases, companies agreed to share proprietary information about their products and provide the product’s strategy with the understanding that Amazon was interested in investing. Some of the startups received initial investments through Amazon.com Inc. or Amazon’s Alexa Fund, while others were offered exploratory meetings to discuss their products.

The Journal stated that it spoke with “two dozen entrepreneurs, investors and deal advisers who said Amazon appeared to use the investment and deal-making process to help develop competing products.”

Within a short period, usually of 6 months to a year following the meetings with potential startups, Amazon would then unveil its own competing product that emulated the initial product showcased by the startup.

Alfred Fabricant, a lawyer representing startup Vocalife, said, “They find technology they think is extremely valuable and seduce people to engage with them, and then cut off all communication after initial sessions with an inventor or company.” He added, “Years later, lo and behold, the technology is in an Amazon device.”

The Journal report highlights stories from numerous startups like DefinedCrowd Corp, Nucleus, LivingSocial, Vocalife LLC, Novel Effect Inc., and Vivint Smart Home Inc.

In a July 23 statement to Business Insider, an Amazon spokesperson said, “For 26 years, we’ve pioneered many features, products, and even whole new categories. From amazon.com itself to Kindle to Echo to AWS, few companies can claim a track record for innovation that rivals Amazon’s.” The spokesperson added, “Unfortunately, there will always be self-interested parties who complain rather than build. Any legitimate disputes about intellectual property ownership are rightly resolved in the courts.”

DA Davidson analyst Tom Forte notes on July 21 that Amazon is not behaving in an anti-competitive manner in regards to its own private-label brands. After comparing 100 products across Amazon and its competitors, he says that it is consistent with the best practices of other retailers. He maintains a Buy rating on the stock but is withholding his price target until Amazon’s earnings are reported on July 30.

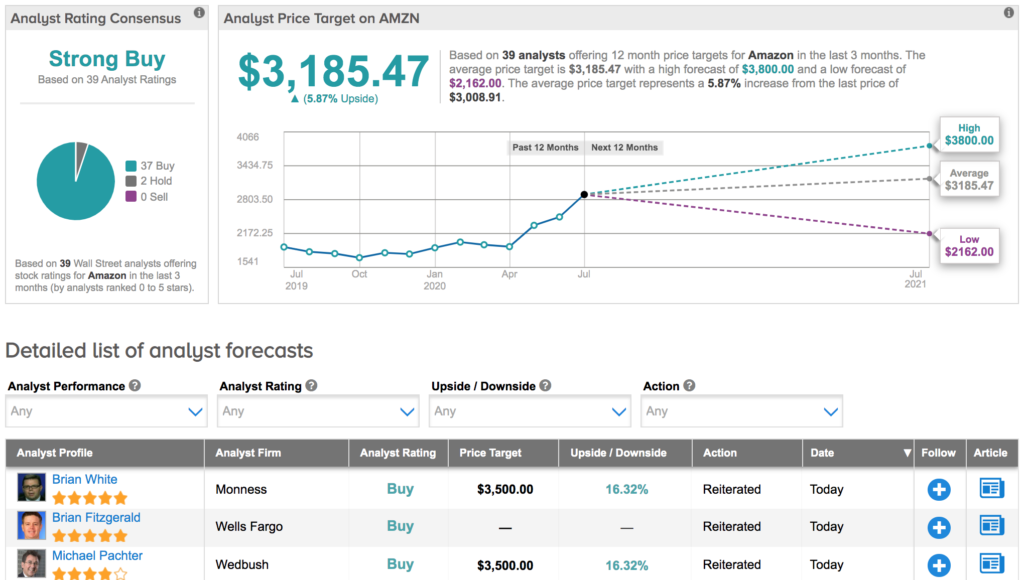

Amazon’s stock is up 63% year-to-date with a Strong Buy analyst consensus that breaks down into 37 Buy ratings versus 2 Hold ratings and no Sell ratings. The $3185.47 average price target implies 6% upside potential for the shares in the coming 12 months. (See Amazon’s stock analysis on TipRanks).

Related News:

Will Amazon Rise Another 19%? These Two 5-Star Analysts Think So

Disney Delays Launch Of Its Marvel TV Series Citing Covid-19 Pandemic

2 “Strong Buy” FAANG Stocks to Watch Into Earnings