While Seaport Research Partners was somewhat blasé about Airbnb (NASDAQ:ABNB), it had some much better things to say about Amazon (NASDAQ:AMZN). The e-retailing juggernaut managed to land some kind words and, in so doing, saw its share price jump, if only fractionally, in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The word from Seaport, via analyst Aaron Kessler, declared Amazon a Buy and established a $145 price target on the stock as well. Kessler notes that Amazon has seen continuing retail margin improvement, spurred on by a combination of fulfillment and shipping improvements. Its advertising momentum is also holding up well, and by altering its distribution network to eight regions for smaller areas instead of one national network, Amazon has dropped “touches” by 20% and miles traveled overall by 18%.

Great news for Amazon, certainly, and it’s also improving some of its offerings. Anime site Crunchyroll is now a part of the Amazon Prime lineup. For $7.99 per month extra, Amazon Prime customers can pick up Crunchyroll as an add-on channel. The end result is said to be much more convenient than trying to navigate Crunchyroll itself and, therefore, worth the slight surcharge to get in.

Is Amazon a Buy or Sell Stock?

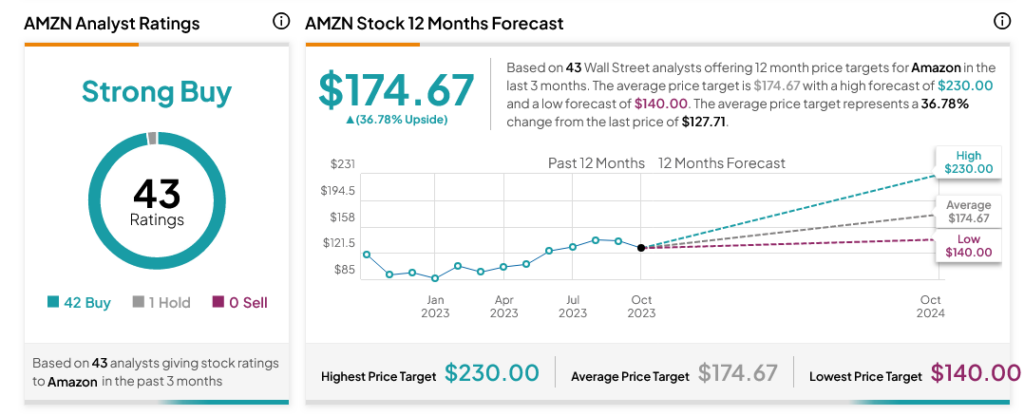

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 42 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $174.67 per share implies 36.78% upside potential.