Amazon (AMZN) plans to expand and strengthen its footprint in the connected health segment. Citing people with knowledge of the matter, the Wall Street Journal (WSJ) reports that the tech giant is eyeing a deal with Peloton Interactive (PTON).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amazon is a U.S. company that offers online retail shopping and cloud computing services. It has three business segments: Amazon Web Services (AWS,) North America, and International.

Acquisition of Peloton

The WSJ report alleges that Amazon has already engaged with advisers as it eyes a potential deal for the embattled health and wellness company. However, there is no guarantee that the e-commerce giant will strike a deal as there are other potential suitors.

Peloton has come under immense pressure recently. Its market value plummeted from record highs of $50 billion to about $8 billion. The pandemic darling has seen investor sentiment turn sour amid a slowdown in growth.

Amazon acquiring Peloton will go a long way in helping the bike company address some of the supply-chain issues that have affected its operations. In addition, Peloton subscriptions would be a great addition to Amazon Prime, which offers users waived shipping costs, streaming, and other services for a monthly fee.

The tech giant has been pushing into the connected health segment recently, with the launch of its Halo Health and Wellness tracker. Therefore gaining access to valuable data from Peloton riders about heart rate and energy consumption could help strengthen other Amazon products.

Analysts’ Take

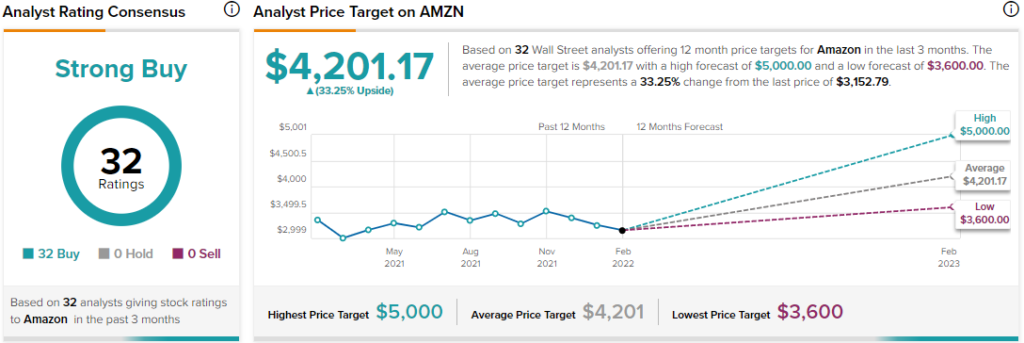

Last week, Morgan Stanley analyst Brian Nowak maintained a Buy rating on Amazon stock with a price target of $4,200. Nowak’s price target suggests 33.22% upside potential. According to the analyst, Amazon’s $6 billion top-end of Q1 operating income guidance affirms its potential full-year profitability.

Consensus among analysts is a Strong Buy based on 32 Buys. The average Amazon price target of $4,201.17 implies 33.25% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Exxon Mobil: Improving Results

EV Makers Beware: Lithium Demand Outpacing Supply

Microsoft Revved Through Earnings; Will Continue to Ramp