Even with the usual short-term ups and downs, the stock markets have posted strong gains this year. As we near the end of Q3, the S&P 500 is up 13%, and the tech-oriented NASDAQ has gained 16.5%. These gains are the fruit of a rally that has proven durable over the long haul.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Looking forward, the consensus is coming down for further US economic growth in the coming quarters. This outlook, on top of the bull market, has Scott Wren, senior global market strategist from Wells Fargo, feeling upbeat.

“Tariff impacts have so far been less than what many had predicted and the labor market is holding in better than expected… Companies are not doing much hiring but they are also not doing much firing. And consumer spending has held in better than many pundits predicted as [the] August Retail Sales report showed. So all else being equal, and given the growth expectations improvement, it makes sense that earnings estimates for the S&P 500 Index (SPX) have also been on the rise. Our projections for economic growth and corporate earnings this year and next are also moving up,” Wren noted.

This stance has been picked up by the stock analysts at Wells Fargo, who are translating the favorable backdrop into new opportunities for investors. In fact, the team has just turned bullish on a pair of high-profile names in the tech sector – Amazon (NASDAQ:AMZN) and CoreWeave (NASDAQ:CRWV) – arguing that both companies are well positioned to ride the current wave of growth and deliver further gains. Let’s find out why.

Amazon

We’ll start with a look at Amazon, the world’s leader in online retail – and, with its $2.34 trillion market cap, also the fifth-most valuable company on Wall Street. Amazon’s core business, of course, is its retail segment; this business is buttressed by a worldwide network of warehouses and delivery assets, and in 2Q25, the last period reported, Amazon’s North American and International segment sales came to nearly $137 billion. The company’s total revenue, at $167.7 billion, was up more than 13% year-over-year.

Amazon has used its powerful lead in online retail to support a wide array of other business ventures, the most prominent of which are its AWS cloud computing platform and its forays into AI. AWS, since its launch, has become one of the most popular subscription cloud services, competing with giants such as Google Cloud and Microsoft’s Azure. AWS generated $30.9 billion in revenue during Q2, for a year-over-year increase of 17.5%.

But AI is where the true excitement lies. AI tech has been a major factor behind the general stock market rally in recent years, and we’re only at the beginning of this boom. Amazon has positioned itself as an important backer of AI advances. The company is using AI tech to enhance the tools and services offered through AWS, and even to integrate new features into its retail website. More importantly, Amazon has backed the AI startup Anthropic, the creator of the Claude AI models, to the tune of $8 billion. Anthropic is involved in Amazon’s Project Rainier, an AI computing initiative by AWS that aims to build out world-class AI supercomputer clusters. The project is based on a distributed architecture, establishing the supercomputer clusters across multiple AWS data centers, allowing for greater power and thermal efficiency without losing the advantages of ultra-low latency interconnections. AWS believes that the cluster design will improve the computing power available to train the Claude models by a factor of five.

Turning to the company’s financials, we can take a closer look at the 2Q25 earnings report. As noted, Amazon’s total revenue was up some 13% year-over-year, at $167.7 billion; this was also $5.6 billion better than had been expected. AWS was the main driver of the revenue gains, as we noted above. Amazon’s bottom-line earnings, at $1.68 per share, beat the forecast by 35 cents per share. Amazon’s operating cash flow over the trailing 12-month period was up 12% year-over-year to reach $121.1 billion.

All of that said, we should note that Amazon’s stock has underperformed this year. Where the NASDAQ has gained 16% for the year-to-date, shares in AMZN are flat. This didn’t stop Well Fargo analyst Ken Gawrelski from taking a bullish outlook here, based on a combination of the company’s strong and growing position in the subscription cloud field and the high potential for returns in its AI forays.

“Upgrading AMZN to OW (from EW) on greater conviction in AWS acceleration in ’26. Raising AWS growth to +22% from prior/consensus of +19%/+18%. We see Project Rainier, a significant compute capacity build w/ partner Anthropic, as the primary driver of acceleration, contributing 5%/4% to AWS growth in ’26/’27. We view AWS revenue acceleration as the key to the reversal of share underperformance YTD… Amazon Retail revenue and margin growth trends remain healthy, despite Project Kuiper investments and FBA fee pressure. See further momentum w/ advertising supporting Retail margins and helping offset tariff/inflation uncertainty,” Gawrelski noted.

Gawrelski’s upgraded Overweight (i.e., Buy) rating comes along with a $280 price target that points toward a one-year upside potential of 27%. (To watch Gawrelski’s track record, click here)

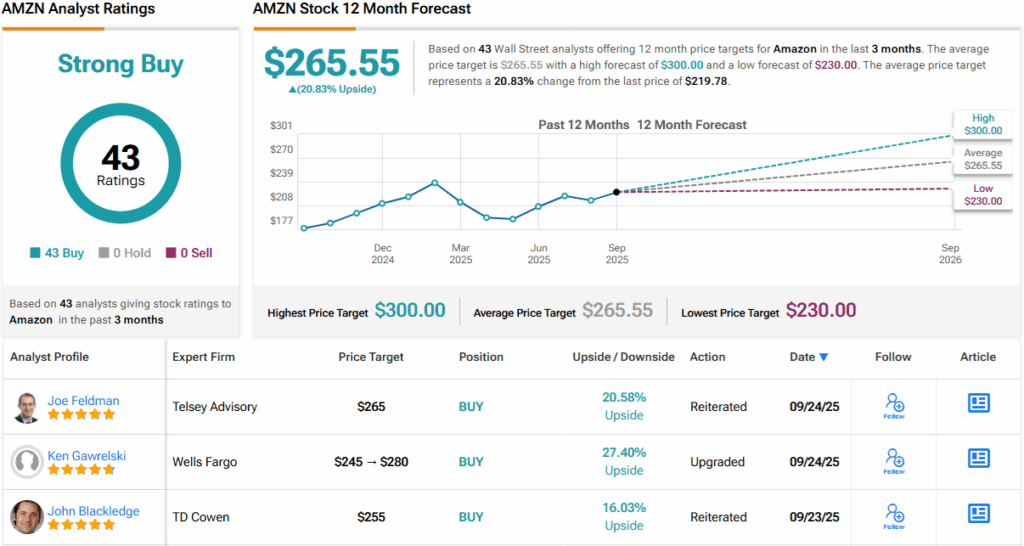

Overall, Amazon gets a Strong Buy consensus rating from the Street, based on 43 recent analyst reviews that are unanimously positive. The company’s stock is trading for $219.78 and its $265.55 average price target implies a ~21% gain in the next 12 months. (See AMZN stock forecast)

CoreWeave

The next stock we’re looking at is relatively new to the public markets. CoreWeave was founded in 2017, and bills itself as ‘the AI Hyperscaler,’ offering its customers access to a leading-edge cloud-based software capable of powering the coming generation of AI products and services. CoreWeave’s cloud platform is purpose-built for AI applications. It is based on GPU clusters that are both reliable and resilient, and is optimized to meet the needs of AI workloads at scale.

The services that CoreWeave provides through its cloud platform are the familiar array of necessary, AI-related, cloud computing offerings: GPU computing capabilities, high-performance networking, flexible storage solutions, managed software, among others. The platform is designed to support AI workloads, with fast spin-up times and 50% fewer daily service interruptions.

CoreWeave is working hard to expand its service footprint, and just this month made two important announcements. The first, on September 16, involved a 1.5 billion GBP commitment to expand its AI data center capacity and operations in the UK. This move brings the company’s total investment in UK AI services to 2.5 billion GBP. And later, on September 25, CoreWeave announced an expansion of its existing contractual agreement with OpenAI. Under the agreement, CoreWeave will provide the platform to power OpenAI’s training of its most advanced next-generation models. The value of the contract expansion is $6.5 billion; the company’s total contract value with OpenAI now stands at $22.4 billion.

As we noted above, CoreWeave is new to the public trading markets. The company held its IPO in March of this year. The company put 36,590,000 shares on the market, while certain ‘existing shareholders’ put up an additional 910,000 shares. The opening price was $40, and the sale of stock generated $1.5 billion in gross proceeds. The event marked the largest US tech IPO since 2021. Since going public, CoreWeave’s stock has gained an impressive 200% and the company now boasts a market cap valuation of ~$60 billion.

CoreWeave reported its 2Q25 results – the company’s first quarter as a publicly traded entity – in August. In the earnings release, the company reported total revenues of $1.212 billion; this was up 210% year-over-year and beat the forecast by $131 million. At its bottom line, the company ran a quarterly net loss of 60 cents per share, missing expectations by 11 cents per share.

This AI company caught the attention of Michael Turrin, who covers the shares for Wells Fargo. Turrin has bumped up his rating on CoreWeave based on the company’s ability to meet the needs of the rapidly growing AI business. He says of CoreWeave: “While the future state of AI remains uncertain, we believe CRWV is set to benefit in the near term as the leading ‘pick-and-shovel’ infrastructure play, while demand continues to outpace supply. Providing GPU capacity to the world’s largest AI labs—incl OpenAI, Google, Meta, & Microsoft—CoreWeave has already begun to show diversification of rev streams, fueling outsized growth with positive unit economics over the next 3 yrs.”

These comments back up the new Overweight (i.e., Buy) rating on the stock, and the analyst’s $170 price target implies a gain of 41% on the one-year horizon. (To watch Turrin’s track record, click here)

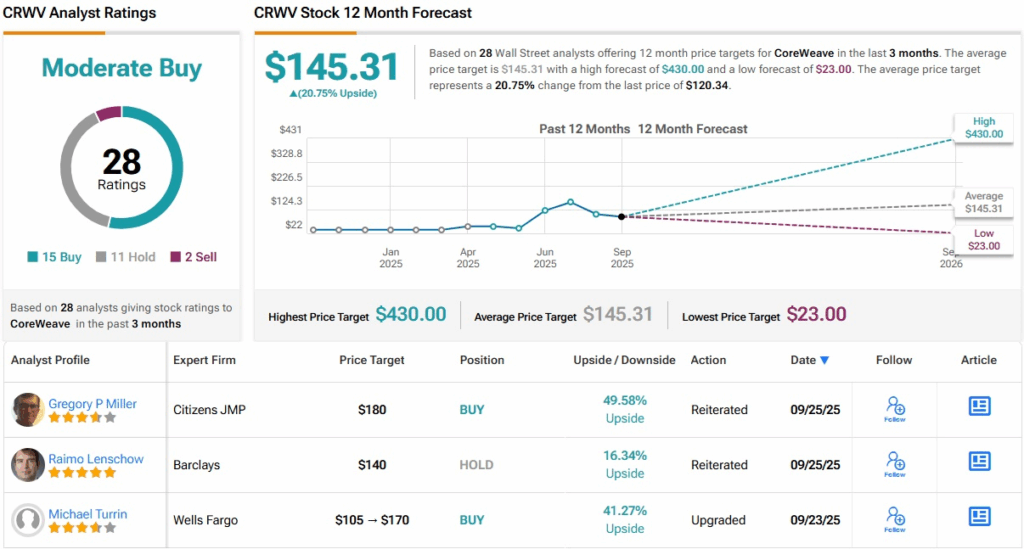

Overall, 15 analysts are firmly in the bull camp, 11 are on the fence, and 2 are betting against the stock – all coalescing into a Moderate Buy consensus rating. At $120.34 a share, the Street’s average price target of $145.31 points to ~21% upside. (See CRWV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.