Earlier today, e-commerce giant Amazon (AMZN) revealed three new AI technologies designed to deliver more value to its customers, employees, and delivery partners. Indeed, the company introduced a generative AI mapping system known as Wellspring, along with an AI-powered demand forecasting model that supports its supply chain, and new agentic AI capabilities for robotics. These tools will help provide more accurate delivery locations, faster shipping options, and better product availability, which will make it easier for customers to get what they want, when they want it.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, Wellspring uses data from satellite images, road networks, building layouts, customer instructions, past deliveries, and street views to improve how accurately Amazon delivers packages to millions of locations. This technology is especially helpful for navigating complex areas, like multi-building apartments or new neighborhoods that don’t yet appear on maps. In addition, Amazon’s new AI forecasting model now factors in time-based data, like weather and holidays, to better predict what products customers will want and where to position them in the supply chain.

Amazon also launched a new agentic AI team within Amazon Robotics with the goal of creating AI that allows “robots to hear, understand natural language, reason about it, and act autonomously.” Using Vision Language Models and robotic action policies, robots will soon be able to follow plain language instructions. This will make robots like Amazon’s Proteus, which already moves customer orders, more versatile by being able to handle heavy items in tight spaces, while allowing human employees to focus on more complex and creative work.

Is Amazon Stock Expected to Rise?

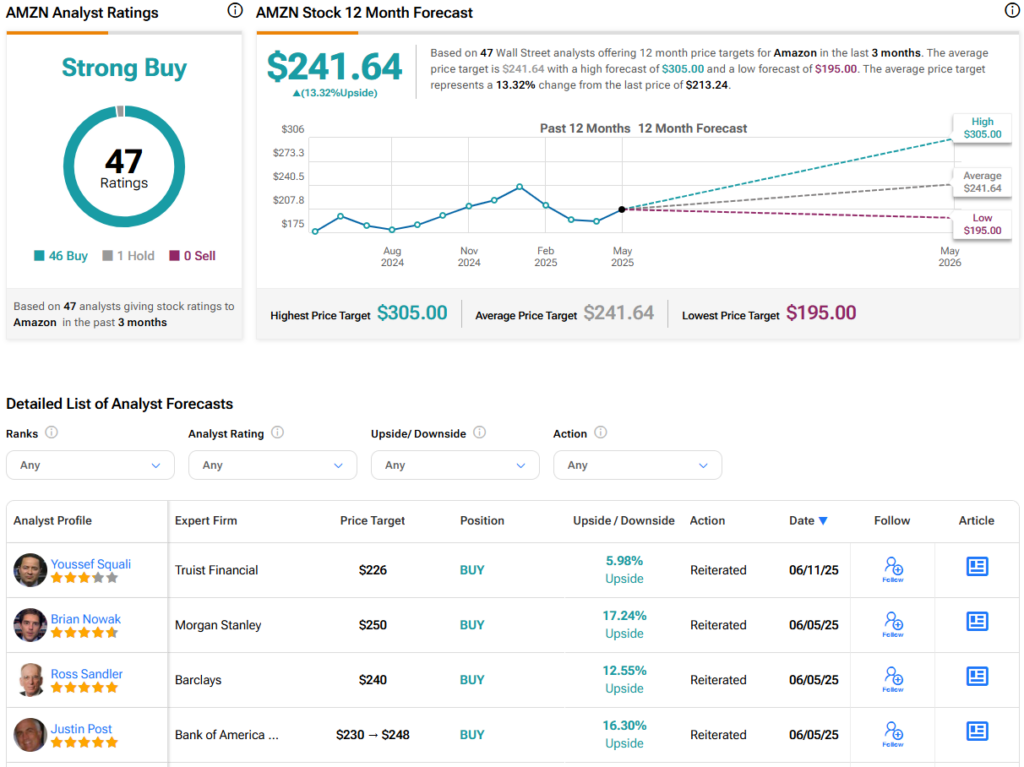

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 46 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $241.64 per share implies 13.3% upside potential.