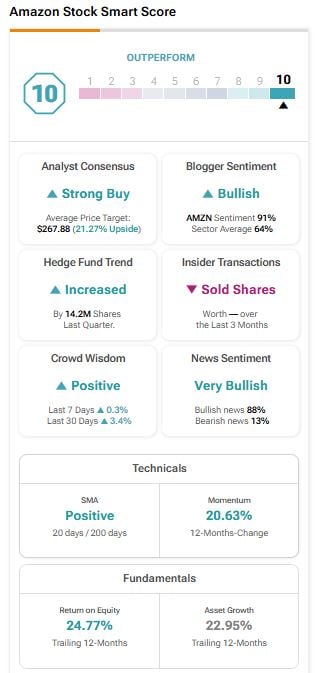

The e-commerce and cloud computing giant Amazon (AMZN) has earned a “Perfect 10” Smart Score from TipRanks. This AI-powered system combines analyst ratings, insider activity, technical indicators, and fundamental data to rate stocks from 1 to 10. A score of 10 is the highest possible and suggests the stock is likely to outperform the market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The top score reflects analyst support, hedge fund buying, bullish news sentiment, and positive technical signals for AMZN stock. Analysts see further upside, with an average price target of $267.88, implying about 21.27% potential gains from current levels.

New Devices Fuel Amazon’s Ecosystem Growth

Amazon recently introduced a range of new AI-powered devices, including upgraded Echo speakers, the new Kindle Scribe, Fire TVs, and improved Ring cameras, all running on a smarter Alexa+ platform. Analysts say these launches show Amazon’s plan to make Alexa more useful and keep users connected across its products.

The company’s growing device lineup also helps drive sales in other areas such as Prime subscriptions, e-commerce, and streaming. By keeping users within its ecosystem, Amazon can collect more data, improve personalization, and strengthen its position against rivals like Apple (AAPL) and Alphabet (GOOGL).

Institutional Support and Technical Signals Boost Confidence

The Perfect 10 score is also supported by strong institutional interest. Hedge funds added nearly 14.2 million Amazon shares last quarter, reflecting growing conviction from large investors.

On the technical side, momentum remains positive. The Williams %R indicator, which measures whether a stock is overbought or oversold, currently shows a Buy signal for AMZN, suggesting the stock still has room to climb.

Analysts Stay Bullish on the Stock

Analysts remain upbeat about Amazon’s growth outlook, especially as Amazon Web Services (AWS) shows signs of renewed strength. The cloud unit is seen as a key driver of future earnings, with rising demand for AI and enterprise solutions expected to boost revenue in the coming quarters.

For instance, Wells Fargo upgraded Amazon to Overweight from Equal Weight and lifted its target to $280 from $245. 5-star analyst Ken Gawrelski said the firm expects Amazon Web Services (AWS) to regain strength after a slow period. He believes improving industry demand and higher AWS forecasts should help support Amazon’s next phase of growth.

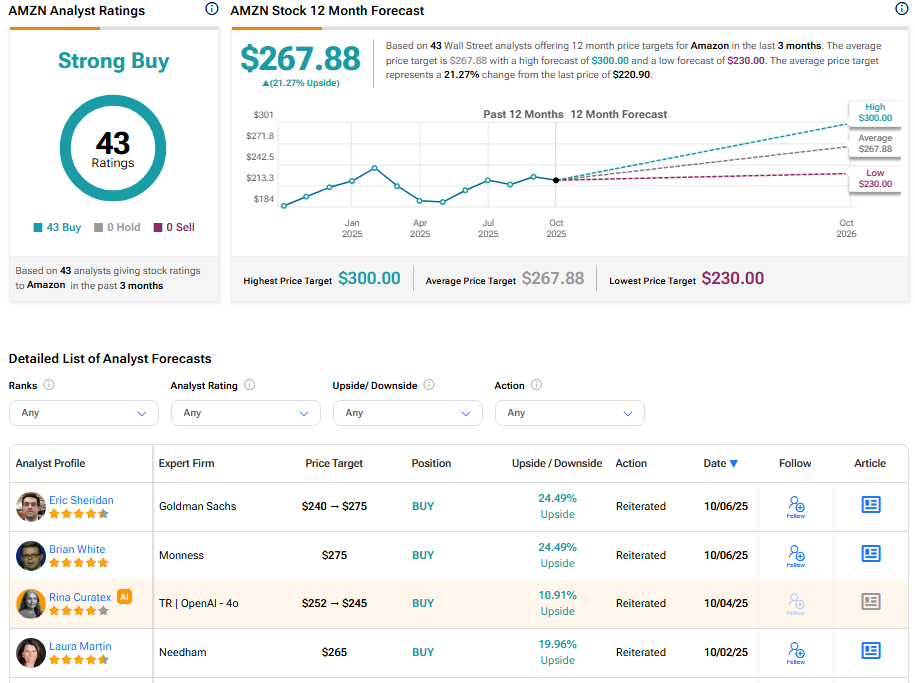

Meanwhile, Goldman Sachs analyst Eric Sheridan recently raised his price target on Amazon to $275 from $240 and kept a Buy rating. He called Amazon a “preferred name” among large-cap stocks, saying the company continues to lead in key areas such as online retail, digital ads, cloud computing, and subscription services.

Is Amazon a Good Long-Term Investment?

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 43 Buys assigned in the past three months, as indicated by the graphic below. After a 22.18% rally in its share price over the past year, the average AMZN price target of $267.88 per share implies 21.27% upside potential.