Tech giant Amazon (AMZN) has agreed to pay $2.5 billion to settle charges from the Federal Trade Commission (FTC), which accused the company of misleading users into signing up for unwanted Prime memberships and making it difficult for them to cancel. This surprise settlement came just three days into a trial. Interestingly, the FTC’s lawsuit, originally filed in June 2023 during the Biden administration, claimed that Amazon had misled tens of millions of customers and attempted to hold three senior executives individually accountable if found guilty.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nevertheless, of the $2.5 billion total, $1 billion will be paid to the government as a civil penalty, and $1.5 billion will be refunded to about 35 million people who were signed up for Prime without fully agreeing or had trouble canceling. Although Amazon denies doing anything wrong, the company agreed to major changes. From now on, it must clearly explain the terms of Prime during sign-up, ask for clear permission before charging users, and make cancellation easier. The settlement also prevents two Amazon executives, Jamil Ghani and Neil Lindsay, from breaking these rules again.

Unsurprisingly, FTC Chairman Andrew Ferguson, who was appointed under the Trump administration, called this one of the agency’s biggest wins. However, the firm’s legal troubles are not over yet. Indeed, the FTC is also suing Amazon in a much bigger antitrust case that accuses it of using monopoly power to push out competitors and raise prices. That case, which will be joined by 17 states, is set to go to trial in 2027.

What Is the Price Target for AMZN Stock?

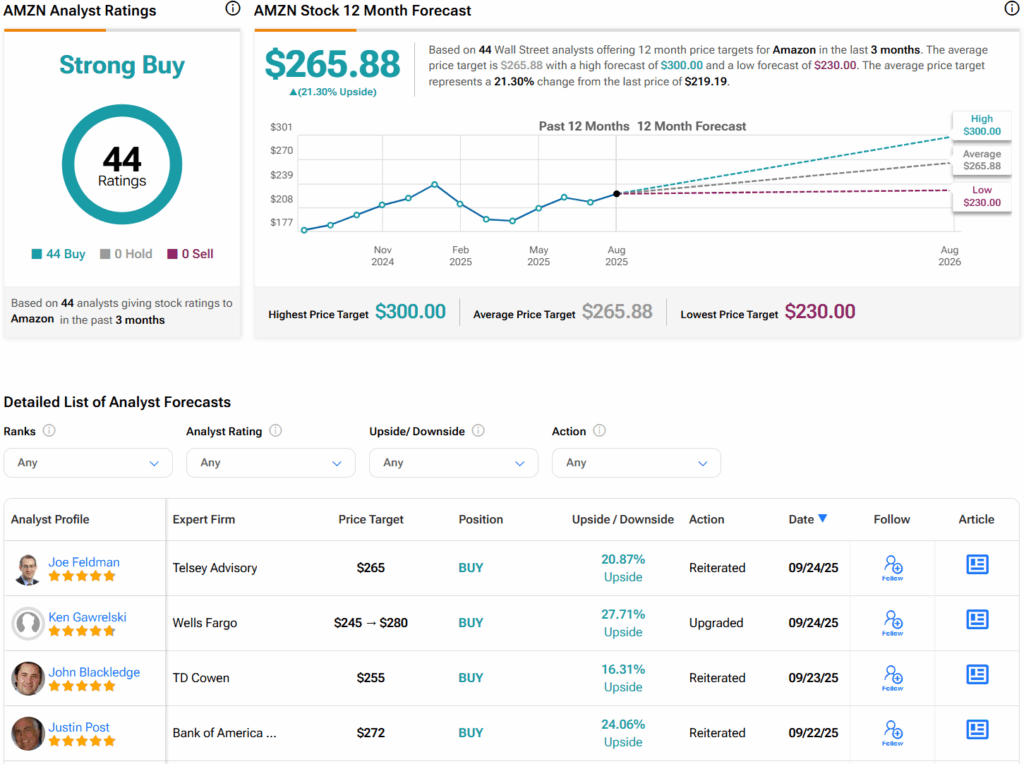

Turning to Wall Street, analysts have a Strong Buy consensus rating on Amazon stock based on 44 Buys assigned in the past three months. Furthermore, the average AMZN stock price target of $265.88 per share implies 21.3% upside potential from current levels.