AltaGas Ltd. (ALA) posted strong Q2 results on Thursday, beating earnings estimates. AltaGas is a Canadian natural gas transportation and distribution company based in Calgary.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Revenue came in at C$2.01 billion for the quarter ended June 30, an increase of 89.6% from C$1.06 billion in the prior-year quarter.

Meanwhile, net income amounted to C$24 million (C$0.09 per share) in Q2 2021, an improvement from C$21 million (C$0.08 per share) in Q2 2020.

Normalized EPS were C$0.08 in the quarter, up 33% from C$0.06 a year earlier. Analysts on average were expecting C$0.01.

Normalized funds from operations reached C$0.56 in the quarter, compared to C$0.51 in the second quarter of 2020.

AltaGas’ President and CEO Randy Crawford said, “We are enthusiastic about our long-term growth prospects and remain confident on being able to achieve the increased financial guidance that was set concurrent with the first quarter…Our continued focus on execution and strong performance will provide the foundation for ongoing dividend growth and profitable expansion that will uniquely position AltaGas to drive long-term shareholder value creation.”

The company maintained its 2021 normalized EPS guidance of C$ 1.65 to C$ 1.80 per share. (See AltaGas Ltd. stock charts on TipRanks)

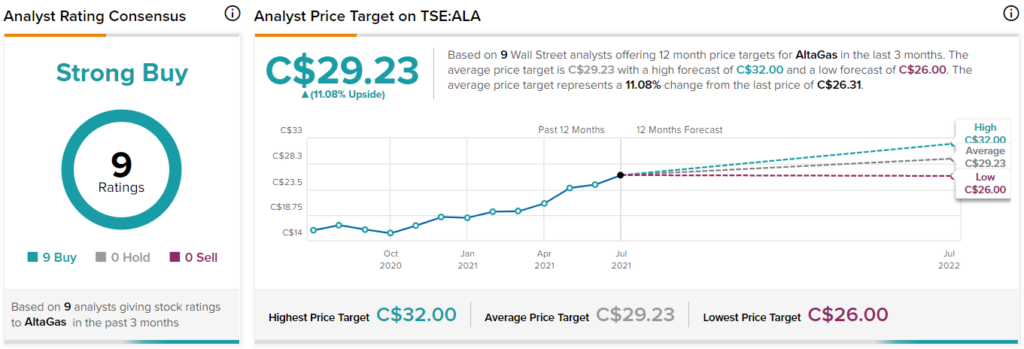

Last week, Credit Suisse analyst Andrew Kuske maintained a Buy rating on ALA and a C$29.00 price target. This implies 10.2% upside potential.

Overall, consensus on the Street is that ALA is a Strong Buy based on 9 Buys. The average AltaGas price target of C$29.23 implies upside potential of about 11% to current levels.

Related News:

Suncor Energy Swings to Profit in Q2

Precision Drilling Posts a C$76M Net Loss in Q2; Shares Plunge 7%

PrairieSky’s Revenues Rise 148% in Q2, Raises Dividend By 38%