Alphabet (NASDAQ:GOOGL)-owned Google has filed a lawsuit against scammers taking advantage of the growing consumer interest in AI (Artificial Intelligence). Per a Wall Street Journal report, the internet search and technology giant has filed a case against unnamed individuals operating in India and Vietnam.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Google asserts that these hackers employ deceptive tactics to lure small business owners into clicking on Meta Platforms (NASDAQ:META)-owned Facebook ads to download Google’s AI chatbot, Bard. However, scammers deploy malware to steal social media credentials once users engage with these ads.

While Google is trying to block these ads, the risks associated with AI have seen a spike in SEC disclosures.

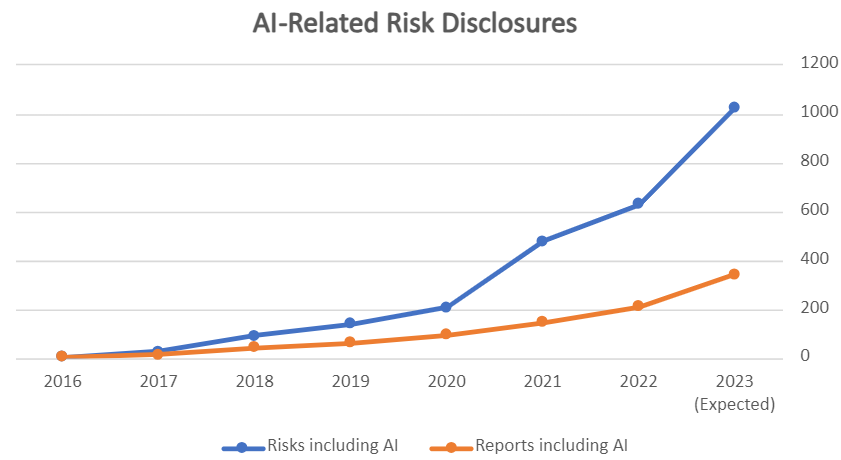

Rise in AI-Related Risk Disclosures

AI, recognized as a revolutionary technology, has the potential to drive innovation, enhance product development, and generate significant productivity gains. As a result, there has been a sharp increase in the demand for and acceptance of AI.

Yet, the rapid advancements in AI could pose significant risks for both small and large enterprises. This is why the risks associated with AI have witnessed a jump in SEC disclosures (see the image below).

While Alphabet is already communicating the risks related to AI via SEC filings, the company is going all-in on AI to bolster its capabilities and capitalize on growing demand.

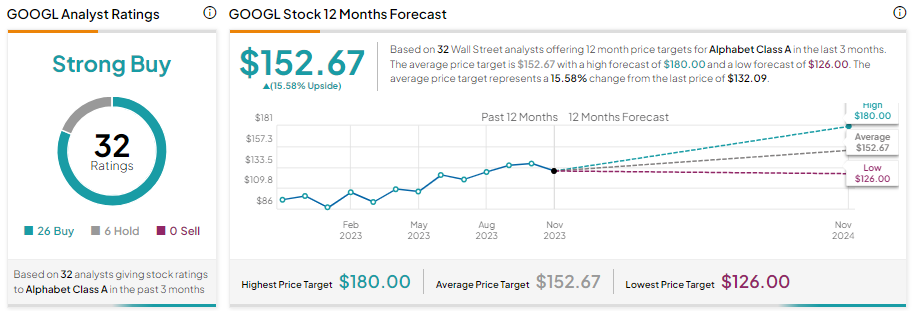

With this backdrop, let’s look at analysts’ recommendations for GOOGL stock.

Is Alphabet Stock Expected to Rise?

Alphabet stock has gained about 50% year-to-date. Despite the significant growth, analysts’ average price target indicates it could rise further.

The stock has received 26 Buy and six Hold recommendations and sports a Strong Buy consensus rating. Further, analysts’ average price target of $152.67 suggests a 15.58% upside potential from current levels.