Alphabet (NASDAQ:GOOGL)-owned Google bets on OpenAI-rival firm Anthropic as competition heats up in the AI (Artificial Intelligence) space. The tech giant will inject a total of $2 billion into the AI firm Anthropic. This strategic move aligns with Google’s efforts to expand its presence in the AI space and keep pace with peers like Microsoft (NASDAQ:MSFT).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Google initially invested $500 million in Anthropic. Further, the company will contribute an additional $1.5 billion over time. This comes on the heels of Amazon’s (NASDAQ:AMZN) investment in the AI company. Notably, in September, Amazon announced a $4 billion investment in Anthropic and a minority ownership position in the company.

In addition to this new funding, Google had already infused $550 million in Anthropic earlier this year, a Wall Street Journal report highlighted. Additionally, Anthropic has also inked a multiyear agreement with Google Cloud valued at over $3 billion.

It’s important to highlight that prominent tech giants are investing in AI startups to bolster their AI capabilities and capitalize on growing demand. In a recent development, Microsoft saw a significant uplift in its Q3 performance thanks to its AI endeavors, particularly within its Cloud division. In contrast, Google’s AI initiatives have yet to make a substantial impact on its financials, with its Cloud division delivering disappointing results in Q3. With Microsoft outperforming Google with its Cloud performance in Q3, let’s look at what the Street recommends for GOOGL stock.

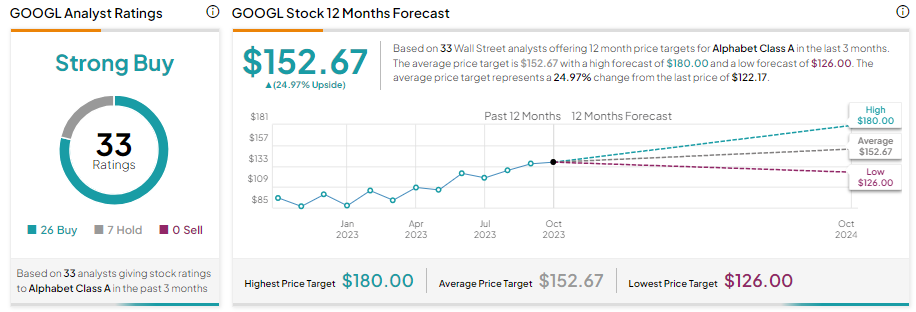

Is Alphabet a Buy, Hold, or Sell?

AI has yet to provide a meaningful impact on Alphabet’s financial performance. Nonetheless, Alphabet is aggressively investing in AI to drive customer engagement and is integrating AI technology across its products and services. Furthermore, Alphabet continues to benefit from the strength of the Search business. Moreover, an anticipated reacceleration in ad spending will support its future growth.

Given these positives, GOOGL stock sports a Strong Buy consensus rating, reflecting 26 Buys and seven Holds. Further, the average GOOGL stock price target of $152.67 implies 24.97% upside potential from current levels.