A senior executive at Alphabet (GOOGL) has confirmed plans by the U.S. tech giant to sell off or spin off Verily, its life sciences subsidiary, according to Bloomberg. Preparation for either move has been underway over the last two years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Heather Adkins, Google’s vice president of security engineering, disclosed the plan while testifying before a U.S. court on Thursday, noting that the tech company no longer sees the unit “as part of our core business”. Adkins testified in a case initiated by U.S. authorities against the tech company over its advertising tech practices.

The confirmation comes over a month after Verily, which develops digital health tools and software to improve patient care, shut down its devices program while relieving team members of their jobs. Verily made the move as part of a strategy to commit more of its resources to its artificial intelligence and data infrastructure efforts.

However, Adkins said Alphabet is working to make Verily an independent company. As part of the plan, the unit is also being transferred from Google’s internal infrastructure to the public cloud service Google Cloud Platform.

Alphabet Pushes Forward with Other Units

Alphabet’s plan for Verily comes at a time when the tech company is pushing forward with its subsidiaries, such as Waymo, YouTube, and DeepMind. For instance, Waymo, which focuses on self-driving technology, recently launched its corporate travel business, even as it continues to expand its self-driving vehicle testing activities across the U.S.

DeepMind has also recently unveiled two AI models to enhance robots’ ability to engage in a more expansive range of real-world tasks, such as manipulating objects and developing advanced spatial understanding.

Is Alphabet a Good Stock to Buy?

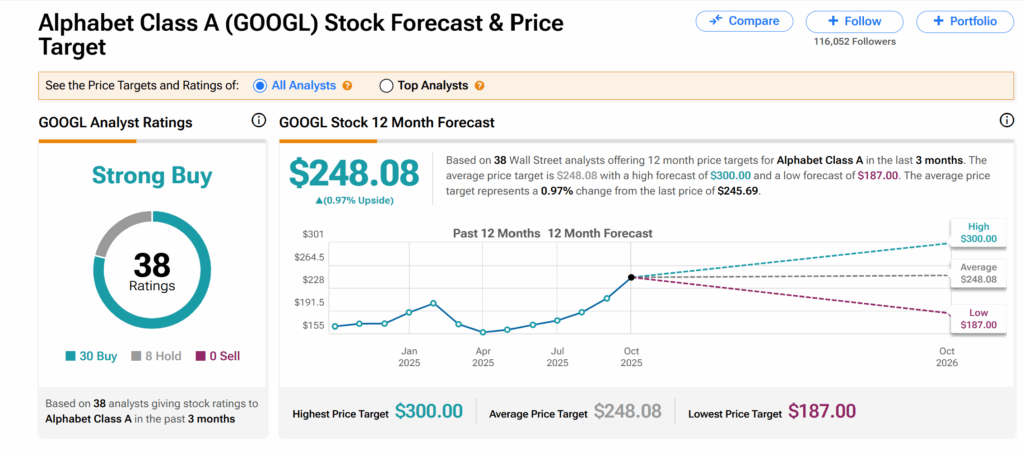

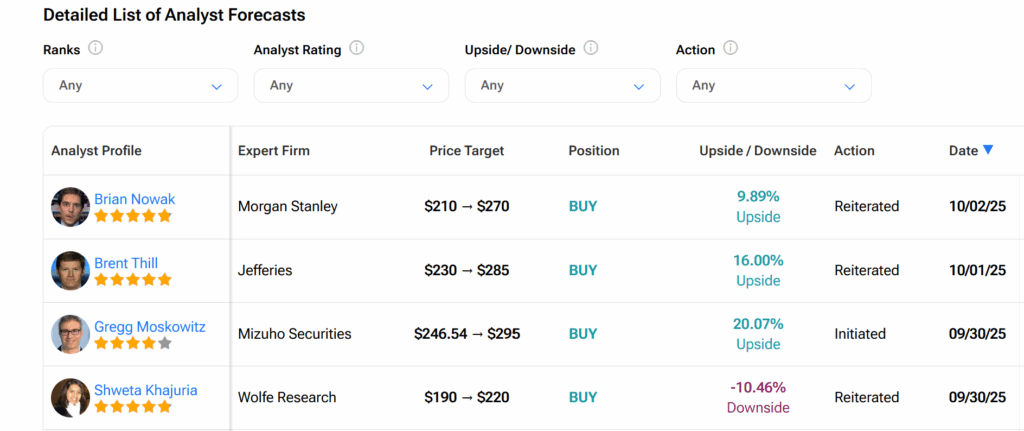

Across Wall Street, Alphabet’s shares currently boast a Strong Buy consensus recommendation, as seen on TipRanks. This is based on 30 Buys and eight Holds assigned by Wall Street analysts over the past three months. However, the average GOOGL price target of $248.08 suggests about 1% downside risk.