Bill Ackman’s Pershing Square Capital heavily invested in Alphabet (NASDAQ:GOOGL) stock during the third quarter. In the latest 13F filing, Pershing Square Capital Management disclosed that its holdings in GOOGL stock nearly doubled on a quarter-over-quarter basis. The firm’s decision to increase its holdings in Alphabet could be seen as a bullish indicator, signaling a Buy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But before jumping to any conclusion, let’s look at the Street’s recommendation for GOOGL stock.

What is the Prediction for Alphabet Stock?

Like Ackman’s Pershing Square Capital, Wall Street analysts are bullish about the tech giant’s stock. Analysts’ optimistic outlook stems from the ongoing strength in the company’s Services revenue, which increased about 11% year-over-year to $68 billion in the third quarter. Moreover, Google’s continued investment in AI (Artificial Intelligence) startups to bolster its AI capabilities and capitalize on growing demand, integration of this transformative technology into its products, particularly Cloud offerings, and a recovery in the ad market support its bull case.

It’s worth noting that Alphabet’s Cloud segment revenue growth rate decelerated sequentially during the third quarter. However, its integration of AI capabilities across its Cloud products and services, and aggressive investments in the segment provide a solid foundation for long-term growth, enabling it to gain market share.

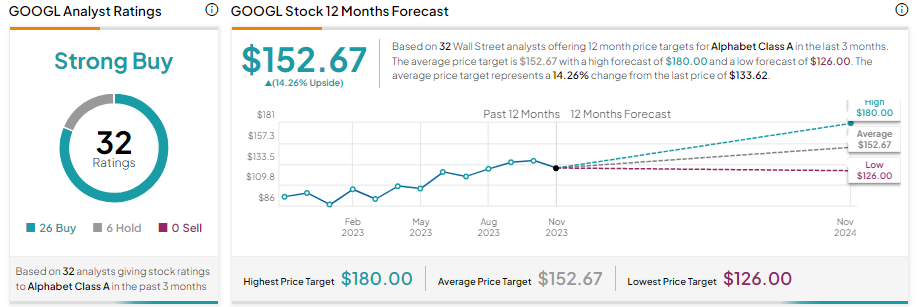

These positives are reflected in analysts’ Strong Buy consensus ratings based on 26 Buy and six Hold recommendations. GOOGL stock has gained over 51% year-to-date. Meanwhile, the average GOOGL stock price target of $152.67 implies 14.26% upside potential from current levels.