Alphabet beat expectations on both revenue and profit. Its stock rose more than 5% as strong cloud growth and rising AI spending signaled that Google’s long-term bet on artificial intelligence is starting to pay off.

Alphabet Stock Jumps after an Earnings Beat. How Google Went From AI Laggard to Leader

Story Highlights

Alphabet (GOOGL) ripped higher in early trading after delivering results that topped Wall Street across the board. The print showed a business leaning into AI while keeping its core engines humming.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Alphabet Beats on Both Lines

Earnings per share came in at $2.87, crushing the $2.26 consensus and rising from $2.12 a year ago. Revenue reached $102.3 billion, ahead of the $99.9 billion estimate and up 16% year over year.

Operating margin landed at 30.5%. If you strip out a $3.5 billion European Commission fine, margin would have been 33.9%, a healthy step up from reported levels. GOOGL shares were up more than 5% around $289 in early trade.

Google’s Cloud Growth Rebuilds Confidence

Google Cloud sales rose 34%, a clear acceleration story the Street wanted to see. Profitability improved too, with operating margin moving to 24% from 17% last year.

This combination of faster growth and better margin is what investors have been waiting for from Google’s AI stack. It suggests the platform is scaling, not just spending.

Capex Plan Grows to Fund AI

Management lifted its 2025 capital-spending outlook for AI data centers to $92 billion, up from $85 billion. The company also guided to a “significant increase” in 2026.

Alphabet has the balance-sheet strength to support it. The company sold $12.5 billion in bonds in May and still holds about $98 billion in cash and short-term investments.

Google Ads Still Pay the Bills

About 85% of revenue still comes from high-margin ads and services. Search and YouTube posted double-digit growth, and Android-related businesses showed strong momentum.

One soft spot remains Google’s third-party ad network, where sales continue to slide amid weaker open-web traffic and antitrust scrutiny. This unit could face changes if the U.S. case advances.

Why the “AI Loser” Label Is Fading

Cloud is winning more deals and throwing off margin. Core ads keep funding the heavy lifting in data centers. Cash flow from operations topped $150 billion over the past 12 months, giving Alphabet fuel to invest without losing financial discipline.

Put simply, Google is shifting from defending share to monetizing AI across products. The latest quarter shows that turn happening in the numbers.

What to Look Out for Next

Looking ahead, investors will be watching several key indicators. The first is how cloud bookings and margins trend through 2026 as Alphabet brings new capacity online. The second is whether there are any developments in the U.S. v. Google antitrust case, which could reshape the company’s third-party ad network. Finally, attention will stay on free cash flow, especially as capital expenditures ramp up again next year.

Overall, Alphabet delivered where it mattered most, showing that its cloud business can grow profitably while funding an even larger AI build-out. That’s how Google is shedding its image as an AI underdog and positioning itself as a serious front-runner.

Is Google a Good Stock to Buy Now?

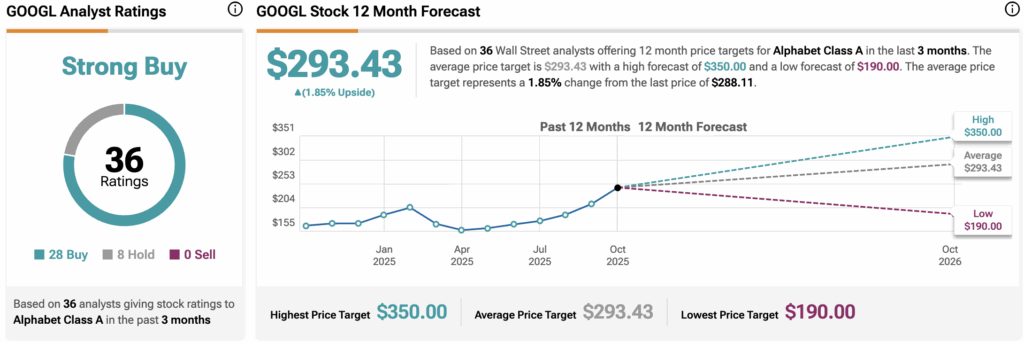

Alphabet holds a Strong Buy consensus based on 36 analyst ratings, with 28 Buys, eight Holds, and no Sells in the mix. The average 12-month GOOGL price target is $293.43, suggesting a modest 1.85% upside from the recent close.

1