The shares of U.S. tech giant Alphabet (GOOGL), which dominates the browser market with its Google Chrome browser, lost their excitement on Thursday afternoon. This came after Nvidia (NVDA)-backed startup Perplexity AI announced that it will launch the free version of its AI-powered browser, Comet, on Thursday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Aravind Srinivas, CEO of Perplexity, told Business Insider that the move is aimed at pushing back “slop” — or shallow content on the internet generated by both humans and AI platforms — even as the AI browser war among new startups and established companies continues to intensify. Alphabet’s shares were down 0.54% to about $244 per share around 12:53 p.m. EDT on Thursday.

Comet Puts Perplexity on Browser Race Lane

Perplexity opened the doors to early access to Comet earlier in July via a $200-per-month premium subscription. The agentic browser works like an ‘agent’: it can book a meeting, send an email, research websites, shop online, and answer questions about a webpage, among others.

The premium subscription for Comet included additional benefits, such as access to the company’s spreadsheet feature, web app, and the Labs presentation tool. However, Aravind noted that the free version being launched will come with limits.

Comet has been positioned as a challenger to Google Chrome’s dominance of the browser market. Perplexity even made a $34.5 billion bid for Chrome before a court judgment in Alphabet’s antitrust case with U.S. authorities thwarted the possibility of the company being forced to sell the browser.

AI Browser War Flares Up

The development comes as startups such as Brave, with its Leo browser, and The Browser Company, with its Arc and Dia browsers, are pushing browsers beyond traditional boundaries, propelled by artificial intelligence. Norwegian tech firm Opera (OPRA) has also joined the race with its Neon browser.

However, Alphabet is also working to step up its game in this regard, recently adding its Gemini AI chatbot to Chrome. Rival Microsoft (MSFT) is also seeking to strengthen its position in this regard; it rolled out an experimental “Copilot Mode” in late July, a move geared toward making the AI assistant faster and smarter.

Is Google a Buy, Hold, or Sell?

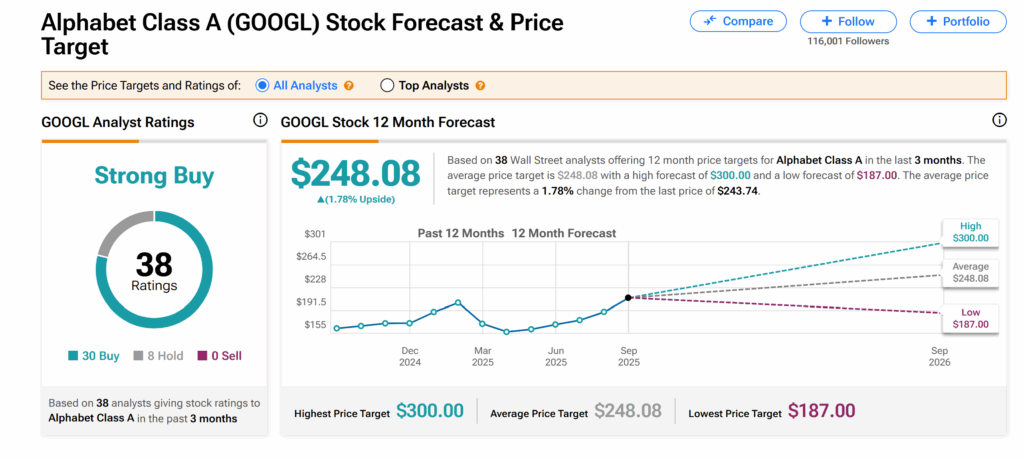

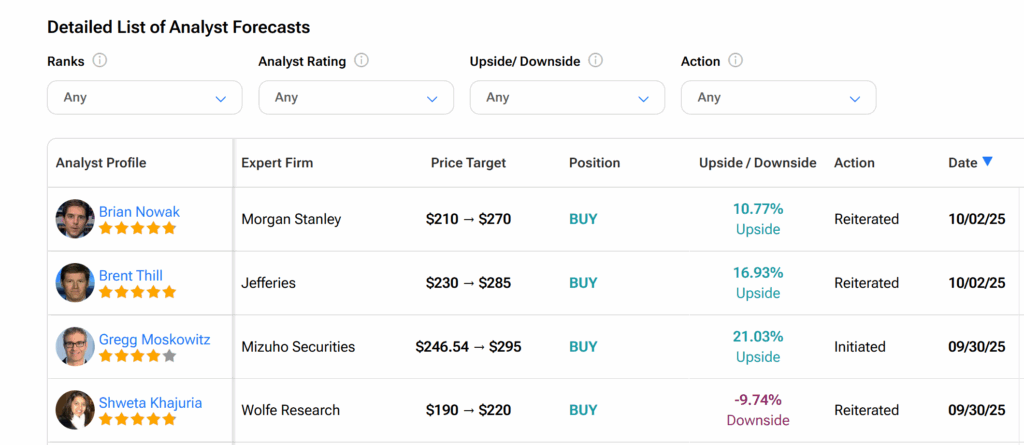

Across Wall Street, Alphabet’s shares currently boast a Strong Buy consensus recommendation, as seen on TipRanks. This is based on 30 Buys and eight Holds assigned by Wall Street analysts over the past three months. However, the average GOOGL price target of $248.08 suggests about 2% downside risk.