Tech giant Alphabet (NASDAQ:GOOGL) is urging the U.K. antitrust regulators to reprimand Microsoft (NASDAQ:MSFT) for its unfair business practices in Britain’s cloud computing market, as per a letter to the CMA (Competition and Markets Authority) seen by Reuters.

Google Seeks Action Against Microsoft

Google alleges that Microsoft’s licensing practices prohibit customers from using rival cloud services. Google also said that despite offering better “prices, quality, security, innovations, and features,” U.K. customers are unable to take up its cloud services due to MSFT’s unfair practices.

Google Cloud Platform (GCP) competes with MSFT’s Azure and Amazon.com’s (NASDAQ:AMZN) Amazon Web Services (AWS) units. In the U.K., AWS and Azure dominate the cloud computing market with approximately 80% share. GCP has roughly 5% to 10% market share.

Google claims that Microsoft’s restrictive licensing practices are the biggest barrier to competition in the U.K. and a major hurdle to customers’ free will. MSFT’s Azure does not provide easy interoperability between cloud providers and withholds customers from security updates while switching. Google is urging the CMA to probe into the matter and push Microsoft to change these restrictive practices.

Is Google Share a Good Buy?

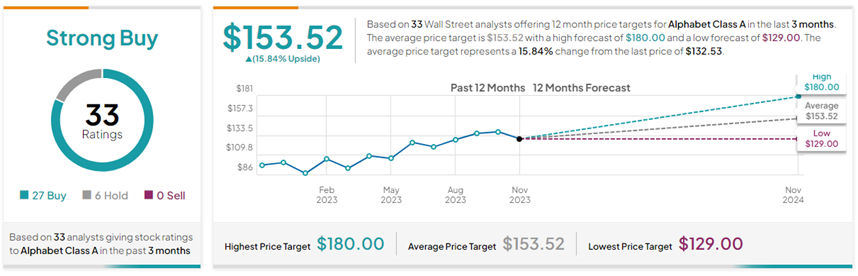

With 27 Buys and six Holds, GOOGL stock has a Strong Buy consensus rating. The average Alphabet Class A price target of $153.52 implies 15.8% upside potential from current levels. Meanwhile, GOOGL stock has gained 48.7%.