Alphabet (GOOGL) has won a legal victory in a case that had accused the company of illegally profiting from scams related to its Google Play gift cards.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A federal judge has thrown out a proposed class action lawsuit that wanted to hold the Google parent company responsible for refunding millions of dollars that had been stolen from consumers in scams that involve Google Play gift cards.

U.S. District Judge Beth Labson Freeman said the plaintiff in the case failed to show that Alphabet was aware of scams involving its gift cards, directly caused any financial losses, or knew that it was receiving stolen funds through scams being perpetrated on consumers. In conclusion, the judge said that Alphabet could not be held liable for the fraud.

Scams on the Rise

The plaintiff in the case, a woman named Judy May, claimed that she lost $1,000 in April 2021 when a scammer posing as a relative instructed her to contact a supposed government agent, who told her she was eligible for federal grant money if she bought Google Play gift cards.

May said she provided the codes on the back of the Google Play gift cards to the scammers, who then used the codes to make purchases. May said in her lawsuit that she would not have bought the cards had Alphabet warned on the packaging about possible scams.

The lawsuit comes as the number of scams rises across the U.S. In 2023, Americans lost $217 million in gift card frauds, according to the Federal Trade Commission (FTC). Interestingly, the FTC noted that Google Play cards account for about 20% of all gift card scams in America.

Alphabet’s stock has increased 22% so far this year.

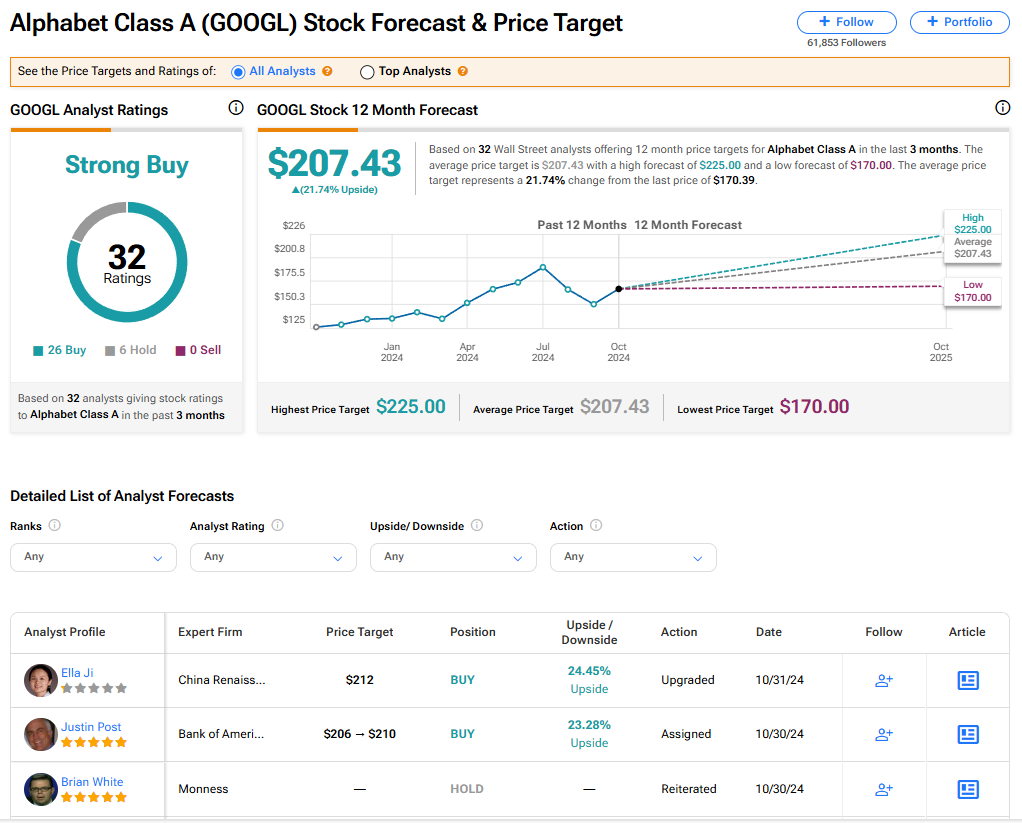

Is GOOGL Stock a Buy?

Alphabet stock has a consensus Strong Buy rating among 32 Wall Street analysts. That rating is based on 26 Buy, six Hold, and no Sell recommendations made in the last three months. The average GOOGL price target of $207.43 implies 21.74% upside potential from current levels.