Alphabet (GOOGL) and Amazon (AMZN) just turned their AI bets into real profits. Both companies reported large gains this week thanks to their investments in Anthropic (ANTPQ), the startup behind the Claude chatbot. The windfall came after Anthropic’s valuation jumped to $183 billion in September, almost triple what it was earlier this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Alphabet reported $10.7 billion in gains from its stock holdings during the quarter. A major share of that came from Anthropic. The Google parent has put about $3 billion into the startup, including $2 billion last year and another $1 billion this year. At the same time, Google Cloud signed a deal to supply Anthropic with one million AI chips starting in 2026. That order will add more than one gigawatt of computing power and is worth tens of billions of dollars.

Amazon also saw a lift. Its quarterly profit rose 38% to $21.2 billion, driven by a $9.5 billion pretax gain from its Anthropic investment. The company has pledged $8 billion to the AI firm and built special data centers through Project Rainier to handle its work. Amazon said this week that the new network is now fully active, marking another step in its AI expansion.

Mixed Results for Microsoft

Microsoft (MSFT) had a different outcome. The company reported a $3.1 billion hit to its profit from its $13.75 billion investment in OpenAI (PC:OPAIQ). Based on that figure, analysts estimate that OpenAI’s market value dropped by about $11.5 billion in the quarter.

The contrast between the companies shows how AI investments can move corporate results in opposite ways. While Alphabet and Amazon benefited from higher valuations, Microsoft faced a markdown under accounting rules that require changes to be reflected even without selling the shares.

AI Bets Start to Show Real Impact

For years, the big tech firms have invested billions in AI companies as long-term plays. Now, those bets are showing up in earnings. The strong gains at Alphabet and Amazon reveal how startup valuations can lift reported profit. Microsoft’s results, on the other hand, remind investors that such moves can also go in reverse.

As AI startups grow and their valuations shift, these stakes are becoming more than just side projects. They are now part of the financial story for the world’s largest tech firms.

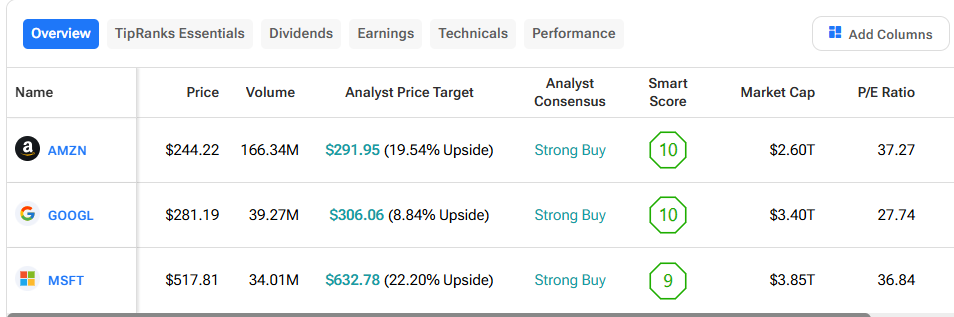

Using TipRanks’ Comparison Tool, we’ve lined up AMZN, GOOGL, and MSFT to see how they compare against each other.