Ally Financial (NYSE:ALLY) will cut jobs across various departments, impacting approximately 5% of its workforce. The all-digital bank is focusing on controlling expenses as higher funding costs and heightened competition for deposits are hurting its net interest margins and earnings.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The rising deposit costs, tougher regulatory environment, and lower non-interest revenues are taking a toll on banks, leading them to cut costs and reduce their workforce. For example, large banks like Goldman Sachs (NYSE:GS) have also been considerably lowering their headcounts to cushion the bottom line amid a challenging economic environment.

Ally Financial emphasizes lowering “controllable expenses (OPEX, comp/headcount) and being disciplined on marketing dollars and tech spend,” Goldman Sachs analyst Ryan Nash told investors in an August 30 report. Summarizing the highlights of his discussion with Ally’s management, Nash said that the company’s management anticipates a potential decrease in costs in the second half of 2023. Additionally, Ally expects its expenses to stay flat or increase by 1% in 2024, which is better than Street’s expectations. Wall Street expects Ally’s expenses to increase by 3% in 2024.

Nash is bullish about Ally Financial stock. The analyst believes ALLY shares could have a significant upside as the net interest margin improves and credit costs normalize or decrease.

While Nash is optimistic about ALLY stock, let’s look at the Street’s consensus rating.

Is Ally a Good Stock to Buy?

Ally Financial is focusing on enhancing net interest margins and reducing costs. However, analysts remain cautiously optimistic due to near-term margin pressures from increased funding costs and a challenging regulatory environment.

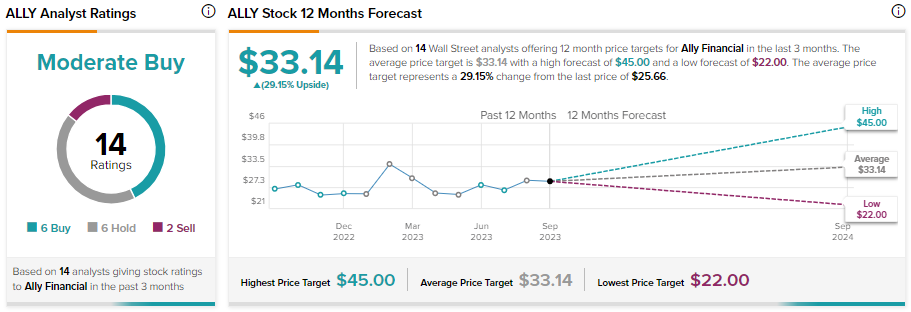

With six Buy, six Hold, and two Sell recommendations, Ally Financial stock has a Moderate Buy consensus rating on TipRanks. Analysts’ average 12-month price target of $33.14 implies 29.15% upside potential from current levels.