Ally Financial reported stronger-than-expected fourth-quarter results due to lower provisions for credit losses and higher net financing revenue. The stock closed 1.7% higher on Friday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ally Financial’s (ALLY) 4Q earnings spiked 69% year-over-year to $1.60 per share and came in far ahead of analysts’ expectations of $0.98 per share. The company’s 4Q revenue of $1.9 billion exceeded the consensus estimates of $1.67 billion and jumped 16% year-over-year. The bank’s net financing revenue improved 12.7% to $1.3 billion in 4Q, while other revenue jumped 39.2% year-over-year to $678 million.

The bank’s 4Q net interest margin (NIM) grew 26 basis points to 2.90%. The improvement in NIM was “driven by higher gains on off-lease vehicles, lower deposit costs, and retail auto portfolio yield expansion, excluding the impact of hedges.”

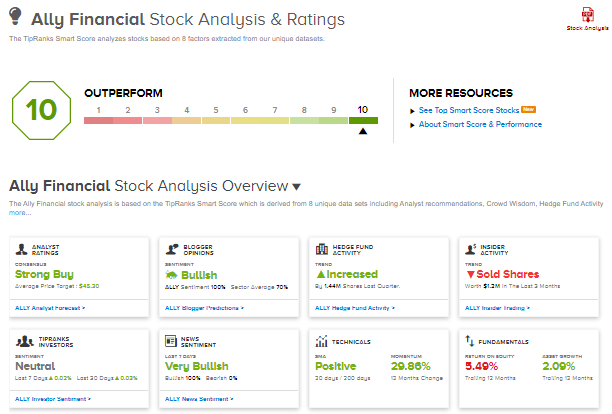

Provision for credit losses decreased to $102 million in 4Q from $276 million in the year-ago quarter, reflecting a reduction in net charge-offs and lower retail auto reserves. (See ALLY stock analysis on TipRanks).

On Jan. 13, Credit Suisse analyst Moshe Orenbuch ramped up the stock’s price target to $42 (3.4% upside potential) from $34 and maintained a Buy rating. Orenbuch’s optimism stems from the expected improvement in origination yields, share repurchases, and steady used vehicle prices.

The rest of the Street is also bullish on the stock, with a Strong Buy analyst consensus based on 10 unanimous Buys. The average analyst price target of $45.30 implies upside potential of about 11.6% to current levels. Shares have gained about 38.7% over the past year.

Furthermore, ALLY scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Ally Financial To Buy Back $1.6B In Stock

IBM’s 4Q Revenues Of $20.4B Disappoint; Shares Fall 7.3% After Hours

Union Pacific Slips 5% On Weak 4Q Freight Revenues