Shares of Allstate Corporation (NYSE:ALL) rose almost 4% on Monday after a Reuters report revealed that activist hedge fund Trian Fund Management has built a stake in the insurance company. Details on the exact percentage of stake purchased by Trian, which is run by billionaire Nelson Peltz, are not available yet.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Allstate Under Activist Pressure

The devastating wildfires in Maui, Hawaii, have adversely impacted Allstate and several other insurers. Moreover, Allstate has reported losses for five consecutive quarters. The interest of an activist investor in the company is expected to put pressure on management, especially long-time CEO Tom Wilson, to turn around the business and improve profitability.

The insurance giant’s second-quarter net loss increased to $1.4 billion from $1 billion in the prior-year quarter due to losses associated with hail storms and weather-related insurance claims. Several insurers have been contending that state regulations make it tough to hike premiums sufficiently to cover wildfires and heightened losses from natural disasters.

Allstate is reportedly seeking the advice of investment banks on how to deal with the activist investor. Currently, no information on Trian’s plans for Allstate is available.

Aside from Allstate, entertainment behemoth Disney (NYSE:DIS) is also under pressure from Trian Fund. After calling off a proxy war earlier this year, Peltz has again reignited his fight with Disney and is seeking multiple board seats.

Is Allstate a Good Stock to Buy Now?

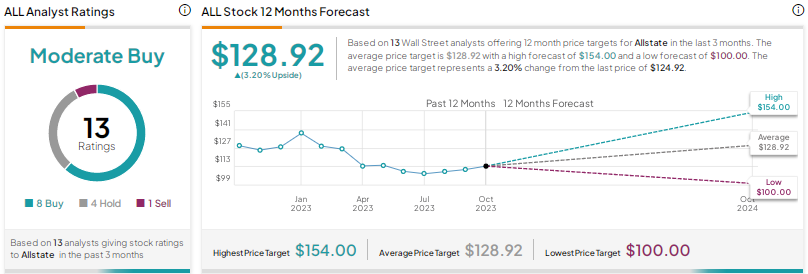

With eight Buys, four Holds, and one Sell, Allstate stock earns a Moderate Buy consensus rating. The average price target of $128.92 implies a modest upside of 3.2%. Shares have declined 8% year-to-date.

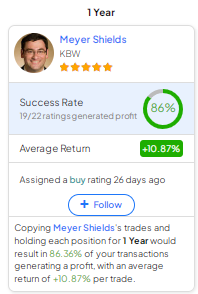

Investors should note that KBW’s Meyer Shields is the most accurate analyst for ALL stock, according to TipRanks. Copying the analyst’s trades on ALL and holding each position for one year could result in 86% of your transactions generating a profit, with an average return of about 11% per trade.