Property, casualty, and other insurance services provider The Allstate Corp. (ALL) inked a deal to acquire SafeAuto for a total consideration of $300 million. Of this, $270 million will be paid in cash, while the remaining amount is payable in the form of pre-close dividends of certain non-insurance assets.

SafeAuto is an auto insurance carrier with a focus on state-minimum private passenger auto insurance and provides coverage options across 28 states. This acquisition broadens Allstate’s product and distribution footprint, the company said.

The transaction, which is likely to close at the end of Q3 is expected to be immediately accretive to Allstate’s earnings.

Peter Rendall, President, National General, Property and Casualty said, “SafeAuto will accelerate our strategy of offering affordable protection solutions by lowering costs and lead to higher growth.” Notably, National General is a subsidiary of Allstate. (See Allstate Corp stock analysis on TipRanks)

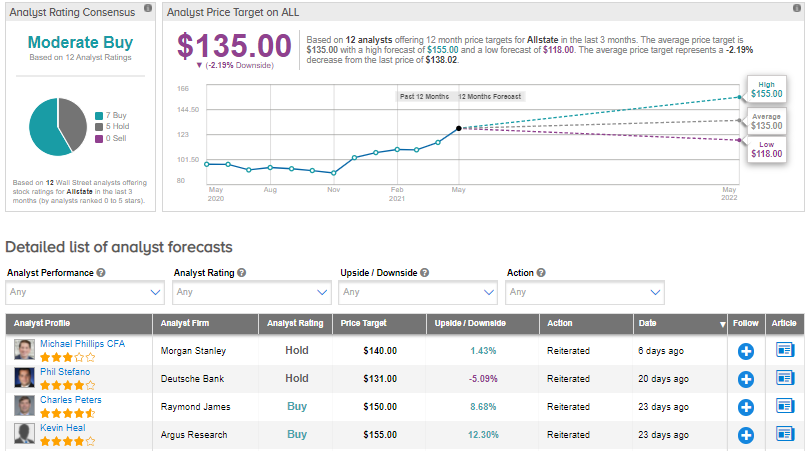

On May 10, Argus Research analyst Kevin Heal reiterated a Buy rating on the stock and increased the price target to $155 (12.3% upside potential) from $125.

Heal highlighted Allstate’s “strong” ROE and underwriting performance coupled with its ability to raise prices, lower costs and grow policies. According to the analyst, Allstate stock has value as the environment for property and casualty insurers seems favorable.

Consensus among analysts is that Allstate is a Moderate Buy based on 7 Buys and 5 Holds. The average analyst price target of $135 implies the stock is almost fairly priced at current levels.

Shares have gained about 27.7% so far this year.

Related News:

HIBB Tops Q1 Estimates, Raises FY22 Guidance

Big Lots Posts Upbeat Q1 Results; Shares Drop 5.5%

LiveXLive Media to Snap up Gramophone Media