A company selling an all-wool shoe could sound like either a maverick visionary or a disaster waiting to happen. For Allbirds (NASDAQ:BIRD), they’re almost certainly hoping it’s the former. But investors aren’t so sure, sending Allbirds shares down 8% in Monday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The celebrity-endorsed all-wool shoemaker took such a hit, mainly after Morgan Stanley analyst Alexandra Straton stepped up and cut Allbirds down to size. While Straton held onto the original rating of “equal weight,” she sliced the price target down from $4 to just $1. Back in March, Allbirds offered up an earnings report that sent shares on a downward slide. However, a rally followed not long after, though Straton isn’t convinced the rally has legs.

Indeed, several other analysts did something similar. Robert W. Baird, for example, dropped both the rating and price target, downgrading from “outperform” to “neutral” and slashing the price target from $7 to just $2. However, others find that Allbirds is showing both “resilience and strength during this challenging time,” and that might give at least some investors confidence. Given what we’ve already seen in shares today, though, that may not hold up much longer.

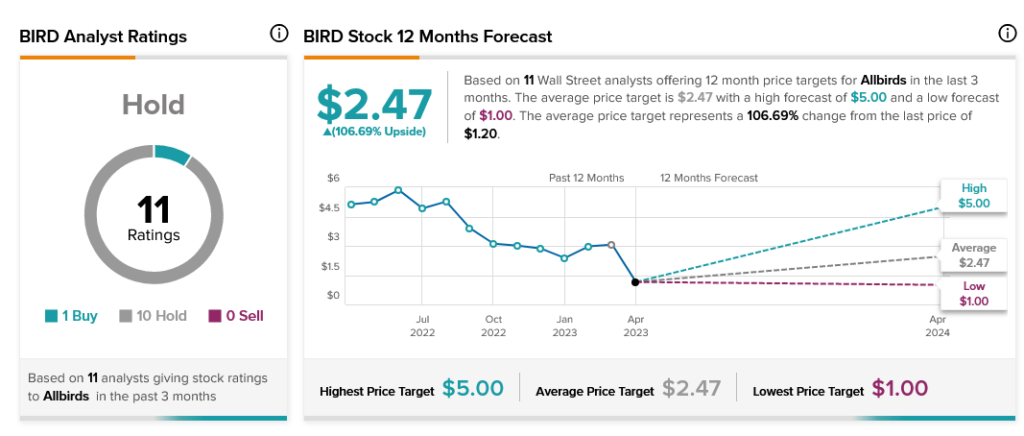

Indeed, confidence has shifted substantially away from being bullish on Allbirds. Current analyst consensus calls Allbirds stock a Hold with just one Buy rating and 10 Holds. However, with an average share price of $2.47, it also boasts a hefty 106.69% upside potential.