After market close, Alimentation Couche-Tard (TSE:ATD), an operator of gas stations and convenience stores, reported mixed Fiscal Q1-2024 earnings results. On the one hand, adjusted earnings per share reached $0.86 (C$1.17) compared to the predicted $0.785 (C$1.07). This represents an increase of just 1.2% from the $0.85 earned during the same period of the previous year. On the other hand, revenue came in at $15.62 billion (16.3% lower year-over-year), missing the consensus estimate of $16.13 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Please note that all figures are in U.S. dollars unless otherwise stated.

Couche-Tard’s Q1 adjusted net earnings were $838 million, marking a decrease from the previous year’s $875 million. Positively, though, total merchandise and service revenues rose by 5% to reach $4.3 billion. The company also reported 2.1% same-store merchandise revenue growth in the U.S., 2.7% in Europe and other regions, and a higher 6.4% growth rate in Canada. Merchandise and service gross margins grew slightly as well due to a beneficial change in product mix.

Next, same-store road transportation fuel volumes rose by just 0.7% in the U.S. and by 7.2% in Canada, but a 1.5% decrease was seen in Europe and other regions. Finally, in the quarter, Couche-Tard bought back 4.7 million shares for a total of $230 million.

Is ATD Stock a Buy, According to Analysts?

According to analysts, ATD stock comes in as a Strong Buy based on 10 unanimous Buys assigned in the past three months. The average ATD stock price target of C$79.30 implies 10.8% upside potential.

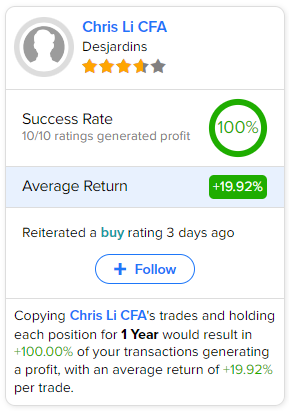

If you’re wondering which analyst you should follow if you want to buy and sell ATD stock, the most accurate analyst covering the stock (on a one-year timeframe) is Chris Li, CFA of Desjardins, with an average return of 19.92% per rating and a 100% success rate. Click the image below to learn more.