The European Commission has opened a formal probe into Alibaba’s (NYSE:BABA) AliExpress under the Digital Services Act. AliExpress is an international e-commerce website run by the Chinese giant. The EU will investigate potential breaches by the website related to illegal content dissemination.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The EU’s Digital Services Act

The EU’s Digital Services Act (DSA) is a regulation regarding illegal content, transparent advertising, and disinformation.

Under the DSA, the EU is investigating whether AliExpress violated this Act when it comes to enforcement of terms of service. The EU Commission has stated that pornographic material accessible on the platform may also be available to minors. The EC stated that the website also offered items that could be hazardous, like counterfeit cosmetics, medications, and supplements. It was suggested that certain internet influencers may have been responsible for making these products accessible, potentially gaining financially through the platform’s “affiliate programme.”

As a result, the commission declared that they are investigating various aspects such as risk management, content moderation, internal complaint handling, transparency in advertising and recommendation systems, tracking of traders, and data accessibility for researchers.

The EU’s DSA Act stipulates that a website should allow a “searchable repository of ads” and the AliExpress website will be under scrutiny in this regard.

Is BABA a Buy, Sell, or Hold?

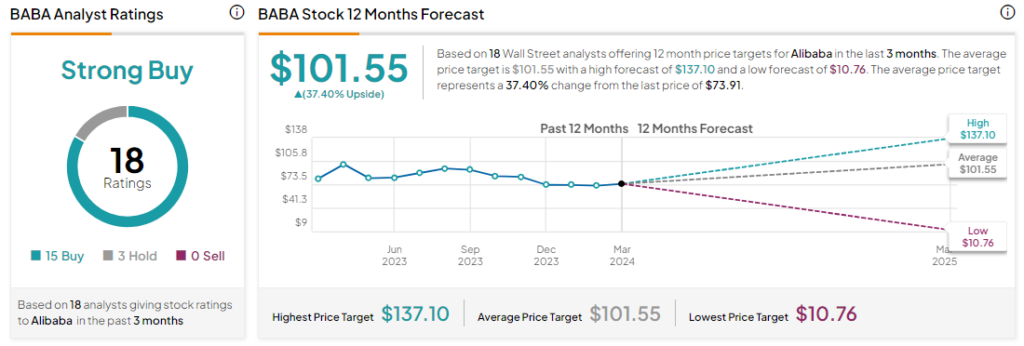

Analysts remain bullish about BABA stock with a Strong Buy consensus rating based on 15 Buys and three Holds. Over the past year, BABA stock has slid by more than 10%, and the average BABA price target of $101.55 implies an upside potential of 37.4% at current levels.