Chinese e-commerce giant Alibaba Group Holding Ltd. (NYSE: BABA) surprised investors by beating Wall Street expectations on both its top and bottom lines. At the time of writing, BABA stock is up nearly 5% on the news during pre-market trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

After witnessing sluggish demand in April and May due to the resurgence of COVID-19 and related lockdowns in China, Alibaba is seeing signs of recovery across its businesses in June. What’s more, the company has even applied for a primary listing in Hong Kong, which will further expand and diversify its investor base.

Delighted with the company’s progress, Toby Xu, CFO of Alibaba, said, “Despite the challenges posed by the COVID-19 resurgence, we delivered stable revenue performance year-over-year. We have narrowed losses in key strategic businesses given ongoing improvements in operating efficiency and increasing focus on cost optimization.”

Alibaba’s Q1FY23 Results Impress

BABA reported adjusted earnings per American Depositary Share (ADS) of $1.75, which came in 19 cents higher than the analyst estimates. However, the figure fell by 29% compared to the same period last year.

Similarly, revenue of $30.69 billion outpaced analyst estimates by $530 million and remained relatively stable compared to the same quarter last year. During Q2, Alibaba’s China’s commerce segment reported a 1% fall in year-over-year revenue to $21.19 billion, while the Cloud segment posted a 10% jump to $2.64 billion.

The Gross Merchandise Value (GMV) of online transactions from China commerce segments, Taobao and Tmall platforms, fell by mid-single digits year-over-year due to the lockdown-related supply chain and logistics issues in China. Nonetheless, both platforms boast high customer retention rates and have continued to see increased demand momentum since June.

Furthermore, the company repurchased 38.6 million ADS during the quarter for approximately $3.5 billion and has around 2.6 billion ADS outstanding as of June 30.

Wall Street Is Optimistic about BABA

Despite all the near-term noise and regulatory crackdown, Wall Street analysts remain optimistic. BABA stock commands a Strong Buy consensus rating based on 21 Buys, one Hold, and one Sell. The average Alibaba price target of $154.05 implies a whopping 60.9% upside potential to current levels. Meanwhile, the stock has lost 20.5% so far this year.

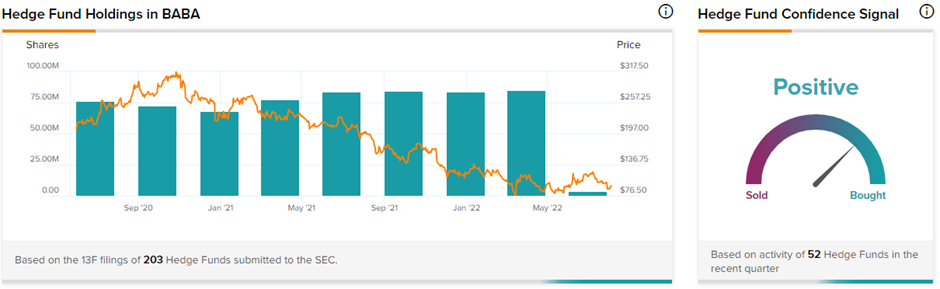

Hedge Funds Are Hoarding BABA

Notably, TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Alibaba is currently Positive, as 52 hedge funds increased their cumulative holdings of BABA stock by 1.1 million shares in the last quarter.

Bloggers Are Bullish on BABA

Additionally, TipRanks data reveals that financial blogger opinions are 78% Bullish on BABA, compared to a sector average of 66%.

Ending Thoughts

Despite the several headwinds, Alibaba has proven its resilience as one of the strongest e-commerce platforms in China. The company is on a sound growth trajectory now that several headwinds are behind it. Plus, the dual listing, when done, will help enhance its user base. Ultimately, analysts, hedge funds, and bloggers continue to back up the Chinese e-commerce giant, making it a reasonable investment choice.