Chinese e-commerce leader Alibaba (BABA) continues to attract strong optimism from both investors and analysts, fueled by its AI and cloud ambitions, along with improving performance in e-commerce and quick commerce. Meanwhile, TipRanks’ A.I. Stock Analysis also assigns an Outperform rating for BABA stock, echoing the broader bullish sentiment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks, giving investors a clear and concise snapshot of a stock’s potential. Moreover, TipRanks’ A.I.-driven rating combines insights from multiple models, including OpenAI’s (PC:OPAIQ) GPT-4o and Perplexity’s SonarPro.

Alibaba Earns Outperform Rating

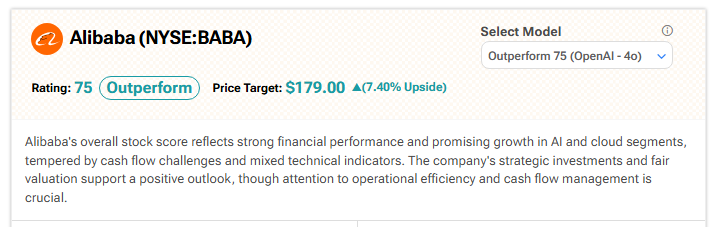

According to TipRanks A.I. Stock Analysis, BABA earns a solid score of 75 out of 100 with an Outperform rating. It also sets a price target of $179.0 for BABA stock, implying an upside of over 7.4% from current levels.

Overall, Alibaba’s stock score reflects strong earnings performance and promising growth in its AI and cloud segments, though cash flow challenges and mixed technical indicators remain areas to watch.

Alibaba’s Strengths Shine, But Risks Remain

The A.I. Stock Analysis highlights both the positive and negative factors influencing the company’s stock performance.

On the positive side, Alibaba continues to gain from growth in AI and cloud services, which is boosting its position in fast-growing tech areas. The company’s Q1 FY26 results showed solid momentum, with revenue reaching 247.7 billion yuan ($34.6 billion) and cloud sales climbing 26% year-over-year to 33.4 billion yuan. Meanwhile, Alibaba’s strategic partnerships, such as its collaboration with SAP, are also expanding its global reach.

However, the analysis points to a few key challenges. Lower adjusted EBITDA and continued cash outflows for new projects may hurt profits. Losses in the quick commerce unit also show rising competition in food delivery and other fast-service areas. These issues could keep pressure on margins and slow short-term earnings growth.

Wall Street Keeps Strong Buy on BABA Stock

On Wall Street, analysts remain optimistic about Alibaba’s outlook. So far this month, 10 analysts have reaffirmed their Buy ratings on the stock.

For instance, in a new report dated October 20, Barclays analyst Jiong Shao reiterated an Overweight rating on Alibaba with a price target of $190, suggesting 14% upside from current levels. The analyst said that while near-term results will likely remain steady, artificial intelligence will be the main driver of value creation for Alibaba shareholders over the next five to ten years.

Shao highlighted that AI-led growth in Alibaba Cloud and continued innovation across its digital ecosystem could strengthen the company’s competitive position.

What Is the Price Target for BABA Stock?

According to TipRanks, BABA stock has a Strong Buy consensus rating based on 20 Buys and two Holds assigned in the last three months. At $195.45, the Alibaba average share price target implies a 17.27% upside potential from the current level.

Year-to-date, BABA stock has gained 99.87%.