Despite last week’s deluge of Big Tech reports, not all tech giants have yet to deliver their latest quarterly statements. A big one will be coming up this Wednesday (February 7th) before the markets open, when Alibaba (NYSE:BABA) announces its third fiscal quarter of 2024 results (December quarter).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Though still considered a major player in the world of Chinese e-commerce, Alibaba’s standing appears to have waned, especially in terms of stock performance. While the last 12 months have been a vintage period for tech, BABA has been excluded from the rally, with the shares down by 26% over the period. So, could the upcoming print be the catalyst for a shift in sentiment?

That remains to be seen, although Barclays analyst Jiong Shao does point out that from a valuation perspective, BABA is currently “among the most compelling names” out there.

The stock might be on a sustained downward trajectory, but even so, through its buyback program and dividends, the company has been doing “more than most peers in returning value to shareholders.” Additionally, despite disappointing investors last year by making a U-turn on its plan to spin-off the cloud business, there’s the prospect of IPOs for its smart logistics unit and its Hema (higher-end offline grocery) business during the first half of this year.

So, patience could be rewarded here eventually, says Shao, who keeps an Overweight (i.e., Buy) rating on Alibaba shares to go alongside a $109 price target, implying the stock has potential upside of ~40% from current levels. (To watch Shao’s track record, click here)

For TH Data Capital analyst Tian Hou, an in-line performance from BABA is to be expected while the analyst is “positive for the 2024 outlook.”

“While China’s economy in 2023 showed unexpected slow growth, it also provided a low base for 2024,” the analyst explained. “China’s economy has its resilience, and it is gradually on its way to recovery. As the e-commerce sector is representative of China’s economy, BABA’s performance also showed such recovery.”

Recent data from the State Statistics Bureau bodes well, showing that total retail sales growth in China has been bouncing back in recent months, climbing 10.1% year-over-year in November after a 7.6% uptick in October.

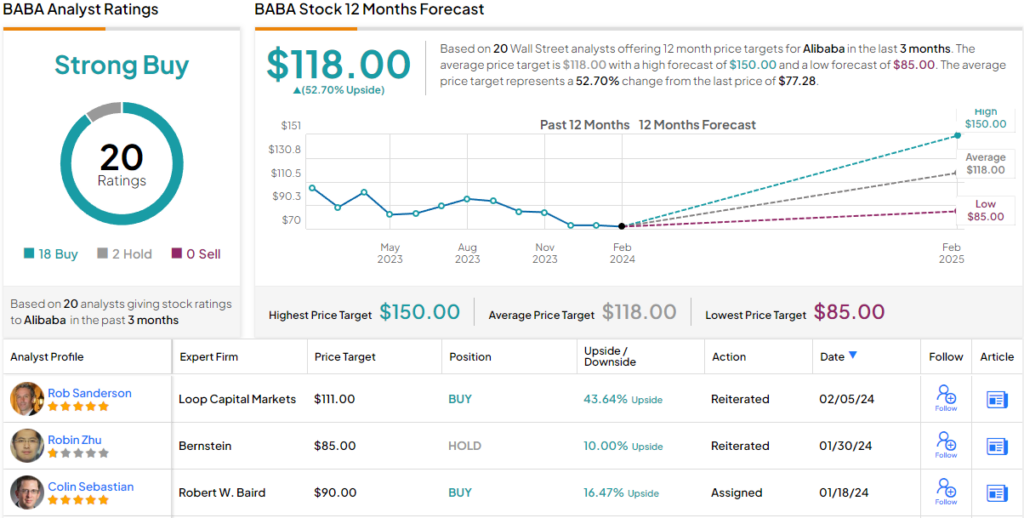

Looking at the consensus breakdown, most on the Street are backing BABA’s chances. Based on a mix of 18 Buys vs. 2 Holds, the stock claims a Strong Buy consensus rating. At $118, the average target factors in one-year growth of ~53%. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.