Shares of Chinese eCommerce giant Alibaba Group (NYSE:BABA) are in focus today on a Financial Times report that the country’s government has picked up shares in BABA’s subsidiary, Lujiao Information Technology.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The development comes as the Chinese government continues to maintain an all-seeing eye over online content in China and has picked up a stake in the media and entertainment wings Youku and UV web of BABA and Tencent.

The so-called ‘golden shares’ enable the government to have a say in certain business matters of these entities. Earlier a state investment fund from Beijing acquired stakes in the subsidiaries of BABA, Bytedance as well as Weibo.

Jack ma, the founder of BABA has been away from the limelight amid the heavy tech crackdown in China and has been reportedly staying in Japan for several months now.

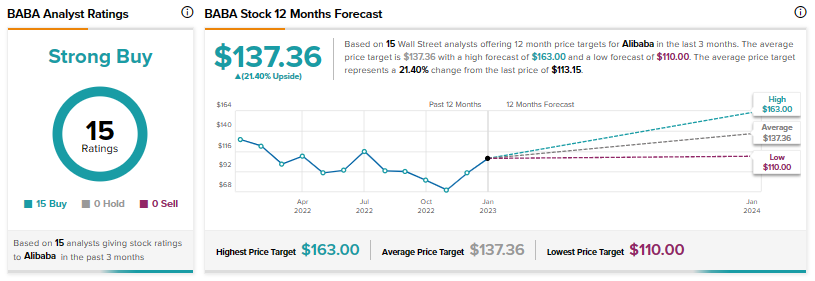

Meanwhile, analysts continue to remain upbeat about BABA and have assigned the stock a Strong Buy consensus rating alongside an average price target of $137.36.

This points to a 21.40% potential upside in the stock on top of the 26.6% gains it has posted over the last month alone.

Read full Disclosure