Alibaba (NASDAQ:BABA) may not be an AI stock, but it’s sure making moves in that direction. The latest gave Alibaba a little extra boost in Wednesday’s trading, as it announced a move that would make it a first in the Chinese market. The move in question is that Alibaba would offer support for Llama 2, the open-source AI system from Meta Platforms (NASDAQ:META). With that support, Chinese users could start making programs that rely on Llama 2 to work. While Meta originally noted that Microsoft (NASDAQ:MSFT) was its partner of choice, it also noted that it was willing to work with other companies as well. Alibaba seems to qualify.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Alibaba is no doubt welcoming the access provided by this move; it comes at a time when the U.S. government is considering whether or not to limit Chinese access to certain technologies. Having that link already in place represents a potential foot in the door that might get it grandfathered in the event that someone does cut off China’s access. This also makes Alibaba the first Chinese firm to get access to Llama 2 and could give Alibaba’s cloud business a little extra life, particularly in China. It might also more closely connect Meta and Alibaba, which might help Meta out. Facebook has been banned in China for quite some time now, and a connection to Alibaba might well help get some of that ban lifted.

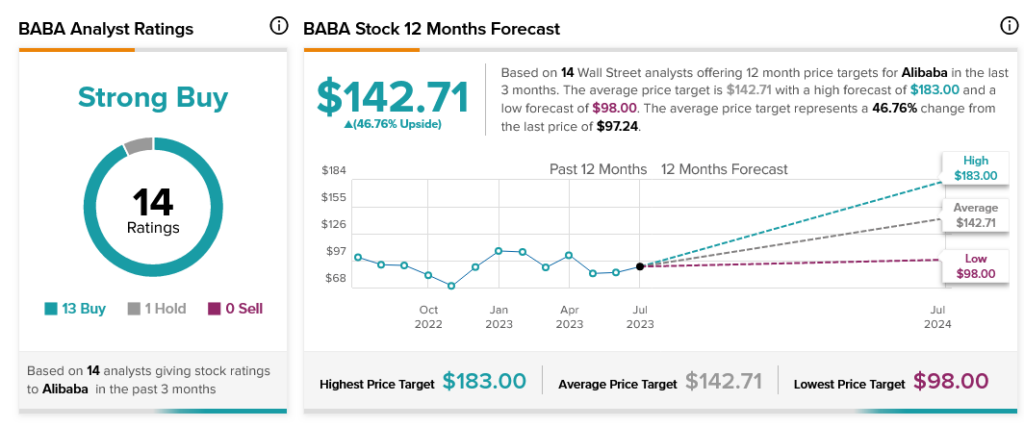

Overall, with 13 Buy ratings and one Hold, Alibaba is considered a Strong Buy by analysts. Further, with an average price target of $142.71, Alibaba stock also offers investors a 46.76% upside potential.