Earlier today, Palantir (PLTR) CEO Alex Karp strongly criticized short-sellers, especially Michael Burry, who is the investor made famous by The Big Short. Indeed, Karp was reacting to a recent filing showing that Burry had placed big bets against Palantir and Nvidia (NVDA). In an interview with CNBC, Karp said it was “bat— crazy” to short the two companies leading in AI: Nvidia with its advanced chips, and Palantir with its AI software tools. He couldn’t understand why anyone would bet against the companies “making all the money.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Karp even stated that he believes this type of short-selling is “egregious” and suggested he’d celebrate if Burry’s bet turns out to be wrong. Nevertheless, despite beating Wall Street’s Q3 expectations and offering a positive outlook, Palantir’s stock sank on Tuesday. Investors seem to be worried about how expensive AI stocks have become, even those with strong earnings. In fact, Palantir shares had risen 173% this year heading into the week and now trade at a high forward price-to-earnings ratio of 228. Nvidia also slipped, despite gaining over 50% this year.

Interestingly, Burry’s hedge fund, Scion Asset Management, held put options worth around $912 million against Palantir and $187 million against Nvidia as of September 30. However, the filing didn’t reveal the option strike prices or expiry dates, so it’s unclear how much he could gain, or if he’s still holding those positions. Karp even questioned whether Burry was truly shorting Palantir, or if he might just be trying to exit without looking foolish. He added that the move honestly feels like market manipulation, especially after Palantir’s strong earnings.

Is PLTR Stock a Good Buy?

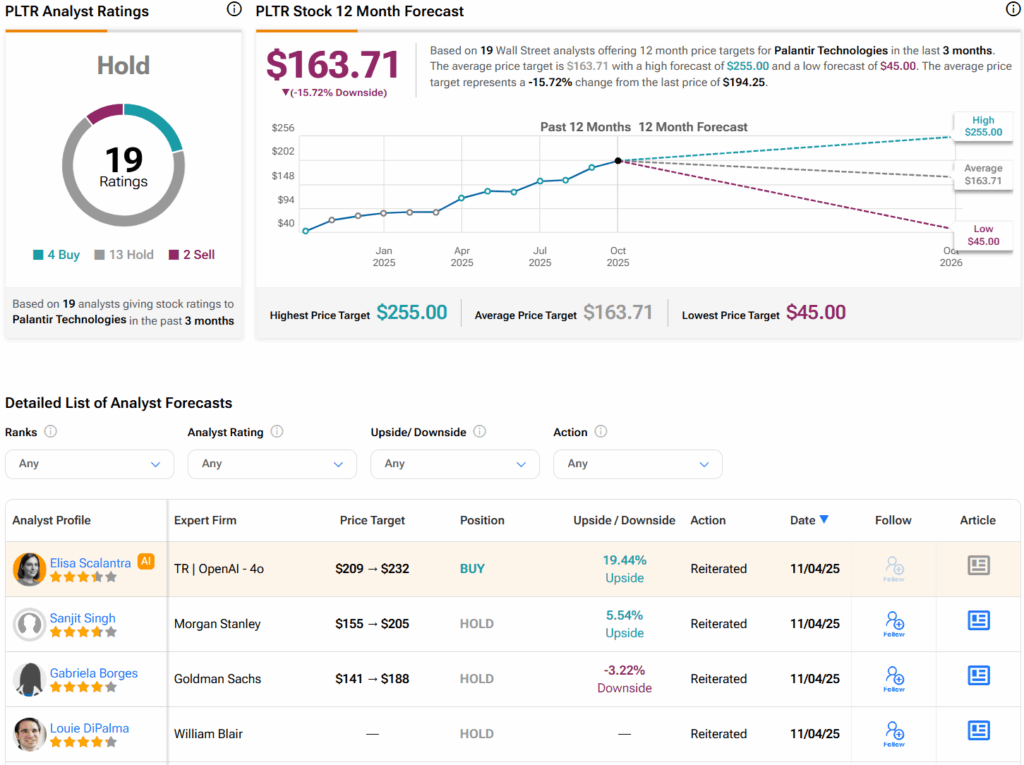

Turning to Wall Street, analysts have a Hold consensus rating on PLTR stock based on four Buys, 13 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average PLTR price target of $163.71 per share implies 15.7% downside risk.