Aluminum producer Alcoa Inc (NYSE:AA) has requested the White House to ban aluminum imports from Russia, in the wake of Russia’s latest military attacks on Ukraine, according to a report by Reuters.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Moscow’s strikes on Kyiv and other cities earlier this week sparked the possibility of a retaliatory blockage of imports of aluminum from Russian aluminum producer Rusal, and Alcoa is reportedly fully supporting it. Separately, Alcoa has also solicited the delisting of Russian aluminum from the London Metal Exchange in an attempt to cripple Russian metal exports.

An embargo on Russian aluminum by major Western (and other) markets would benefit non-Russian metal producers like Alcoa. This is probably why the American metal stalwart is pushing for the ban with such alacrity.

However, from the point of view of the global manufacturing supply chain, which is already weighed down by multiple headwinds this year, a ban on Russian aluminum trade in dollars could deepen the disruptions. Notably, Rusal is one of the largest aluminum exporters of metal, and the manufacturing sectors of several countries, particularly European countries, depend on imports of metal from Russia.

Is Alcoa Stock a Good Buy?

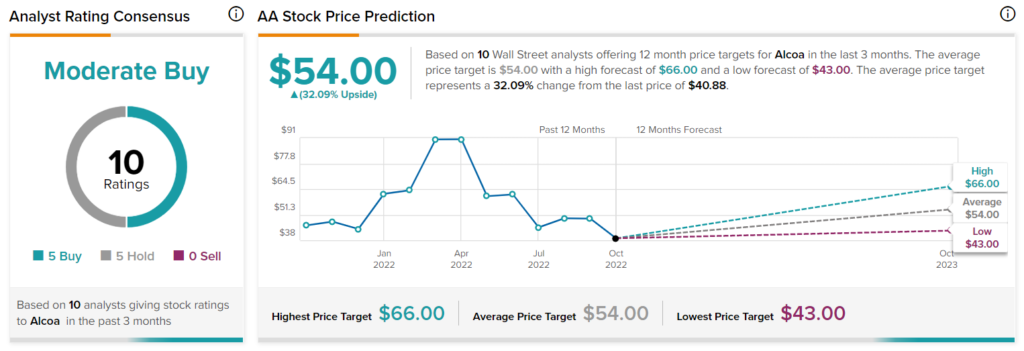

Wall Street is cautiously optimistic about Alcoa’s stock, with a Moderate Buy consensus rating based on five Buys and five Holds. The average price target for AA stock is $54, indicating 32% growth prospects over the next 12 months.