It’s not looking good for grocery chain Albertsons (NYSE:ACI) right now. A proposed deal from fellow grocery chain Kroger’s (NYSE:KR) is likely to be challenged by the Federal Trade Commission (FTC), which has been on an absolute tear of challenging merger and acquisition deals as of late. Albertsons is down fractionally in Friday afternoon trading as a result, but there may be a silver lining afoot.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Originally, Kroger’s was planning to acquire Albertsons in a deal valued at $25 billion. But word from Axios Pro suggests that the FTC is likely to challenge that. Both Albertsons and Kroger are set to meet with FTC elements to offer calming reassurances and offer potential remedies with divestitures that might help the FTC better swallow the deal. After all, Albertsons already announced plans to sell off 413 of its stores to C&S Wholesale Grocers in a bid to keep antitrust regulators from interfering in yet another deal. Kroger also offloaded around 400 stores itself.

However, there may be a way around that if Albertsons and Kroger’s can work quickly. Reports from Bloomberg Law note that should there be a federal government shutdown—of the kind that’s likely to happen if something serious doesn’t change by early Saturday morning—then the FTC has a grand total of three weeks worth of funding to continue operations. It will seek to “pause” any active litigation, though Bloomberg Law also notes that it’s “exceedingly rare” for litigation to continue after staff begin to go on furlough.

Is Albertsons Stock a Good Buy?

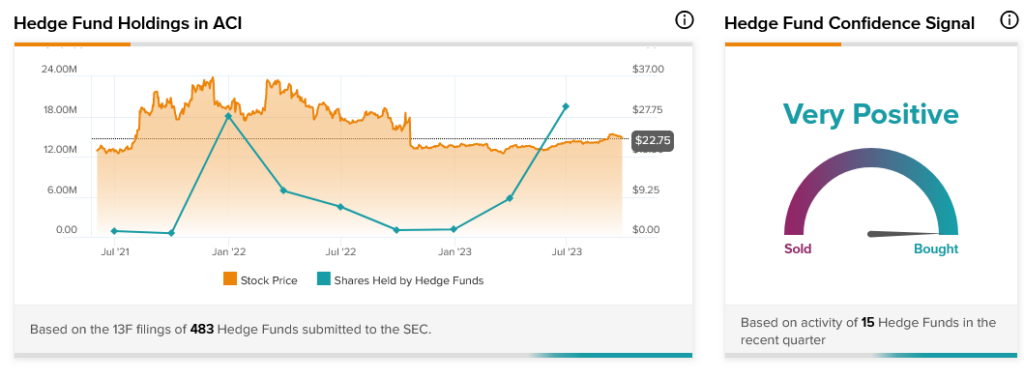

Despite this, hedge funds are clearly very interested in Albertsons. In fact, hedge fund confidence is considered Very Positive right now, hiking their holdings an extra 13.8 million shares this quarter. This is also the second consecutive quarter that hedge funds upped their holdings. Indeed, they haven’t owned this many shares of Albertsons in the last two years at least.