Albemarle (NYSE:ALB) has withdrawn its $4.16 billion acquisition offer for lithium miner Liontown Resources (NYSE:LTR). This decision comes shortly after Australian billionaire Gina Rinehart raised her equity stake in Liontown last week to 19.9% from 18.36%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company cited the increasing complexities of the planned deal as a reason for withdrawing its bid. Albemarle CEO Kent Masters said that “moving forward with the acquisition, at this time, is not in Albemarle’s best interests.”

It is worth mentioning that the latest proposal of A$3 cash per share was ALB’s fourth attempt to acquire Liontown. Prior to this, ALB had made offers at $2.50 per share on March 27, $2.35 on March 3, and $2.20 on October 20, 2022. Liontown had rejected all these proposals, stating that they were too low.

Had the LTR deal been successful, it could have potentially strengthened Albemarle’s presence in Australia. In addition, the deal would have given ALB a boost to complete its supply agreement with Ford (F).

Is ALB a Good Stock to Buy?

Wall Street analysts expect the ALB stock price to reach $257 in the next 12 months, on average, implying an upside potential of 57.3%. Moreover, analysts are cautiously optimistic about the prospects of the stock, with a Moderate Buy rating based on 12 Buys, three Holds, and one Sell. The stock has been down 31.1% in the past three months.

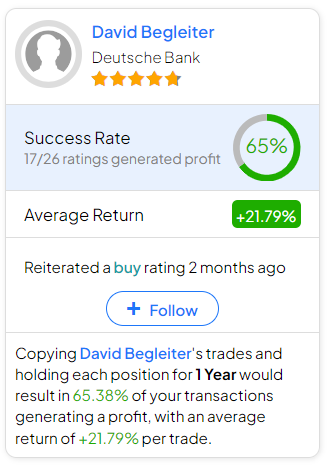

Investors looking for the most accurate analyst for ALB could follow Deutsche Bank analyst David Begleiter. Copying his trades on this stock and holding each position for one year could result in 65% of your transactions generating a profit, with an average return of 21.79% per trade.