Shares of air carrier Alaska Air Group (NYSE:ALK) are trending lower today after its third-quarter EPS of $1.83 fell short of expectations by $0.03. Revenue of $2.84 billion remained essentially flat with a year-over-year rise of 0.4%. The figure missed analysts’ expectations by $30 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Despite challenging macroeconomic conditions, the company notched an adjusted pretax margin of 11.4% and finished the quarter with a debt-to-capitalization ratio of 48%. Importantly, ALK has now transitioned to an all-Boeing (NYSE:BA) fleet. In Q3, it added five 737-9 aircraft and two E175 aircraft, taking the total Alaska and Horizon fleet size to 56 and 41, respectively.

For the full Fiscal year 2023, ALK expects total revenue growth to be in the range of 7% to 8%. EPS for the year is anticipated to be in the range of $4.25 to $4.75. For the upcoming quarter, total revenue growth is expected to be in the range of 1% to 4%. Economic fuel cost per gallon in Q4 is anticipated to be between $3.30 and $3.40.

Is ALK a Good Stock to Buy?

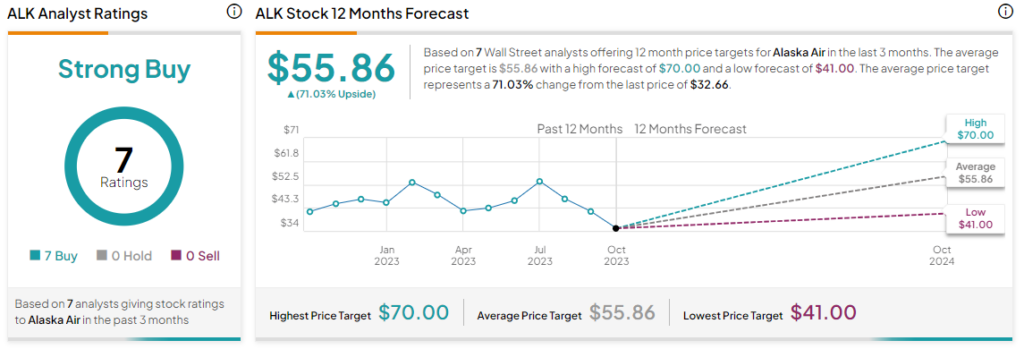

Overall, the Street has a Strong Buy consensus rating on Alaska Air. The average ALK price target of $55.86 implies a massive 71% potential upside.

Read full Disclosure